Wealth managers with retail investors can design and manage portfolios for their clients through a holistic view of investment risk

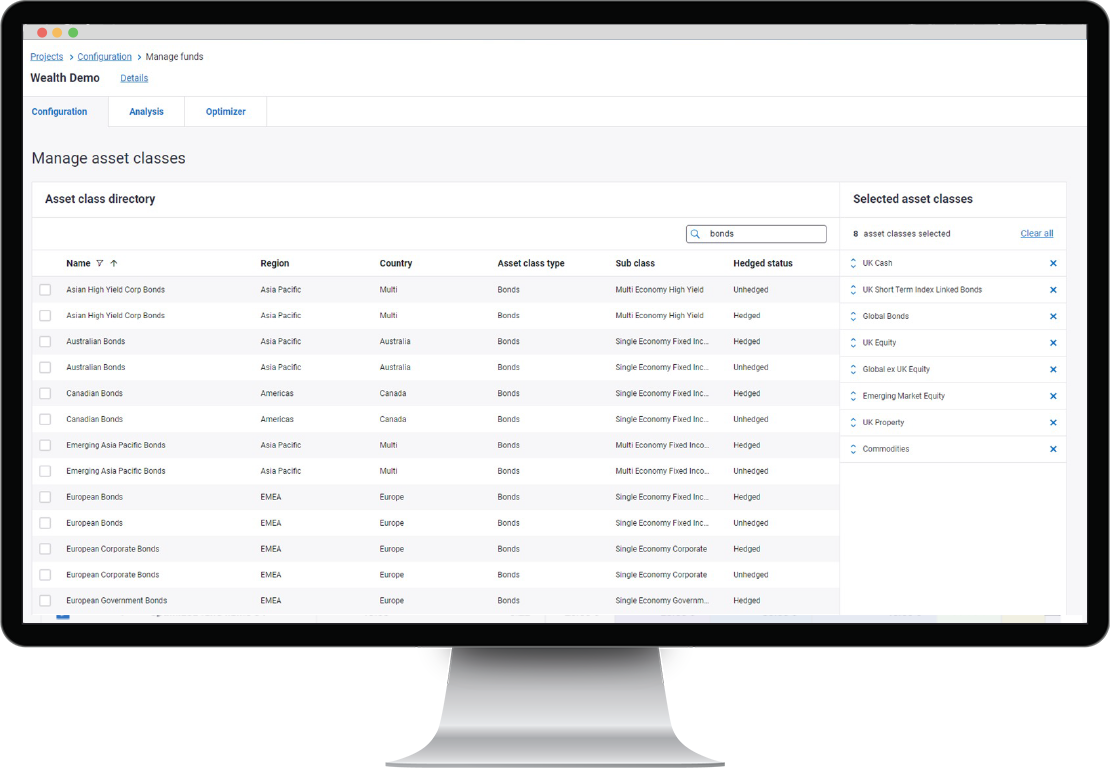

No investment allocation decision should be made in isolation. For the wealth market, that means understanding the impact of investment strategy on risk and return and ultimately a customer’s outcomes. PFaroe Wealth allows wealth and asset managers to design portfolios aligned to the risk profile of their target customers using an independent and objective economic model.

PFaroe Wealth’s regular, easy-to-access analytics allow wealth managers and their clients to monitor and report on a portfolio’s risk and return position efficiently. It also enables investment managers to regularly stress test the effectiveness of risk management strategies, and work with clients in an interactive way to evolve solutions over time. User-friendly analysis dramatically increases the understanding and engagement of clients, and enriches the relationship.

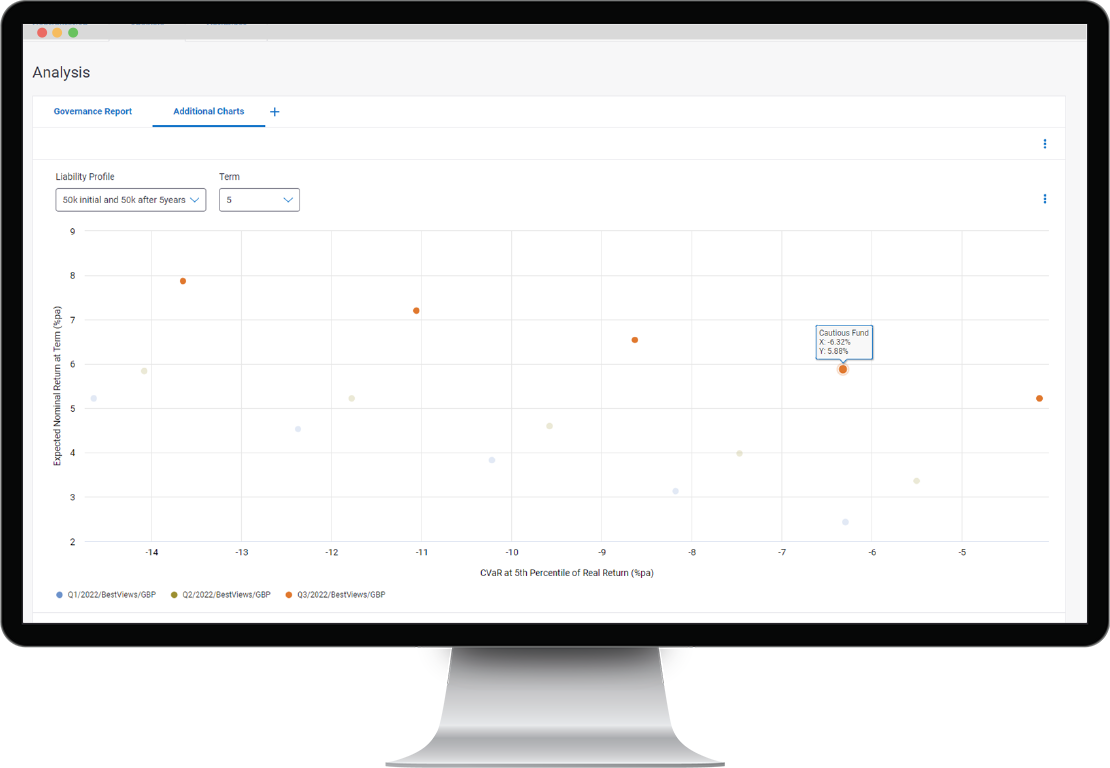

PFaroe Wealth enables wealth management firms to easily demonstrate suitability by aligning the risk characteristics of their portfolios to the needs of their clients objectives. Tracking changes in a portfolio’s risk over time ensures that strategies continue to meet the needs of their target customers’. Leverage Moody’s market leading scenario modelling to provide a forward-looking lens with which to understand the ongoing risk of a portfolio. Integrated asset-liability analytics enables customer outcomes to be factored into both design and governance analysis.

PFaroe Wealth provides a user-friendly platform to engage with customers more interactively than ever before, providing real-time asset forecasting data that can be embedded into online investor applications. Enabling comprehensive ‘what if?’ functionality allows discussions and scenario testing at point of recommendation and makes digital advice more robust. PFaroe Wealth makes complicated concepts and analytics intuitive, leading to more informed customers with a desire for increased, and deeper, dialogue with their wealth manager.

PFaroe Wealth’s easy-to-access yet sophisticated analytics allow investment managers to demonstrate how they align their solutions to their customers outcomes. For internal governance reports, managers are no longer burdened by maintenance of complex data, models and reporting, and can instead focus on ensuring decisions are made consistently and transparently using quantitative information and objective analysis.

Understand what makes PFaroe different. Test it for yourself. Contact us to schedule a one-on-one consultation with one of our experts.

The Real-World Scenario Generator contains stochastic asset models and calibration content that support realistic projections of asset returns and risk-factor distributions.

The CreditEdge platform provides a leading probability of default model for managing the credit risk of your portfolio of listed firms and sovereigns, globally.

Sustainability and climate change are fundamental considerations to seize opportunities and manage risk in today’s global capital markets.

Risk Market Technology Awards - 2022

Winner

Risk Market Technology Awards - 2021

Winner

InsuranceERM Annual Awards 2021

Winner

Risk Market Technology Awards - 2020

Winner

InsuranceERM Annual Awards 2020 - Americas

Winner