We provide modern technology solutions to Asset Owners, Asset Managers, Consultants & Insurers to help grow and improve their business.

New institutional risk modeling platform offers powerful portfolio analytics and risk management capabilities for the wealth and retirement market.

Read MoreFor insurers, access to dependable climate data and scenario models is essential for supporting a wide range of business-critical activities – from Own Risk Solvency Assessment (ORSA)

Read MoreMoody’s Analytics has won the Buy-side ALM Production of the Year in the Chartis Buy-Side Risk Rankings.

- Anthony Hilton, Business Editor for Evening Standard

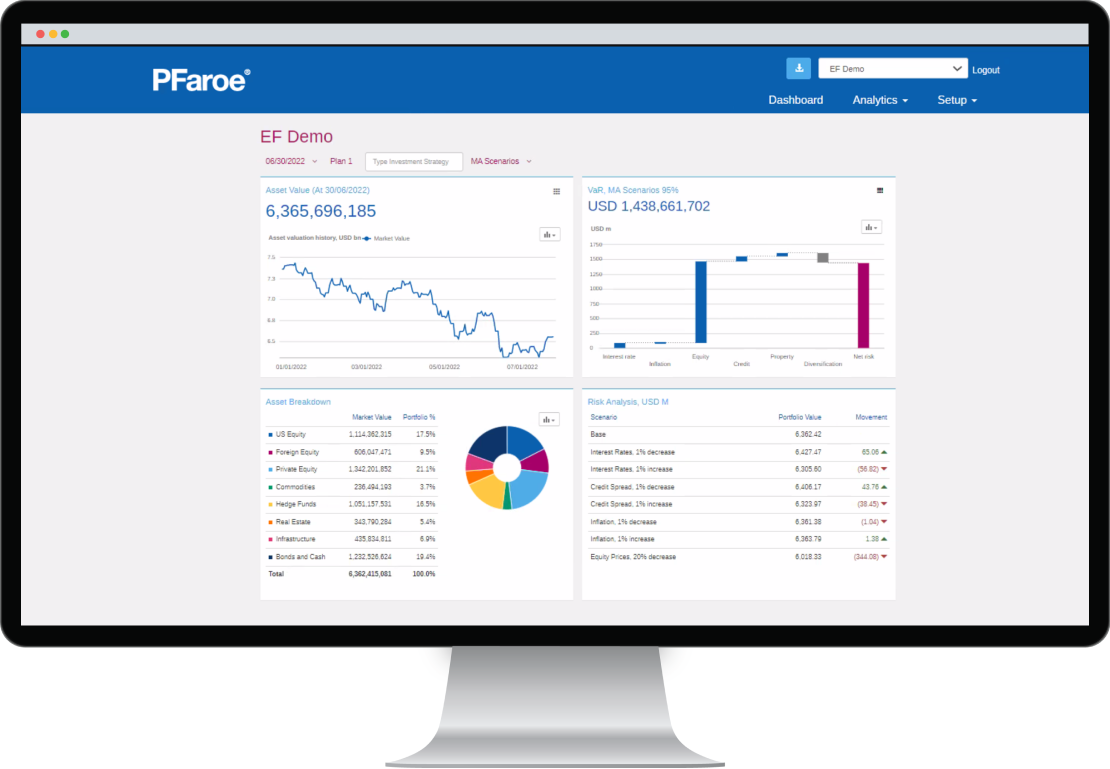

Our comprehensive suite of pension risk management solutions helps pension plans achieve their plan objectives, improve operational efficiencies and bring more oversight in-house.

Our robust solutions for non-profit organizations deliver investment risk and simulation analytics for endowment or foundation portfolios with a focus on spending requirements and achieving mission objectives.

Our solutions empower consultants to engage with clients more interactively than ever before, providing on-demand analysis of asset owner investment portfolios aligned to their investment objectives.

Our flexible and interactive solutions deliver powerful portfolio analytics and reporting that are closely aligned to the business needs of investment managers supporting the retention and growth of assets under management.

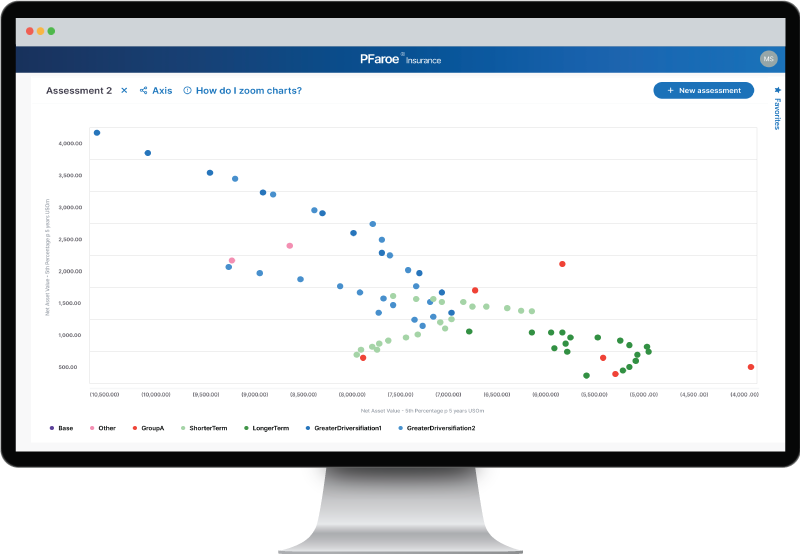

Our tools provide advanced analytics to insurers and their consultants and asset managers – enabling them to align investments with an insurer’s liabilities, planning objectives and risk framework.

Our solutions are designed to meet the needs of asset managers and wealth managers requiring robust analytics to meet the compliance and regulatory requirements for retail investment clients.

would recommend the PFaroe DB platform to another organization

would be disappointed if they were no longer able to use the PFaroe DB platform

rely on the PFaroe DB platform modeling every single day

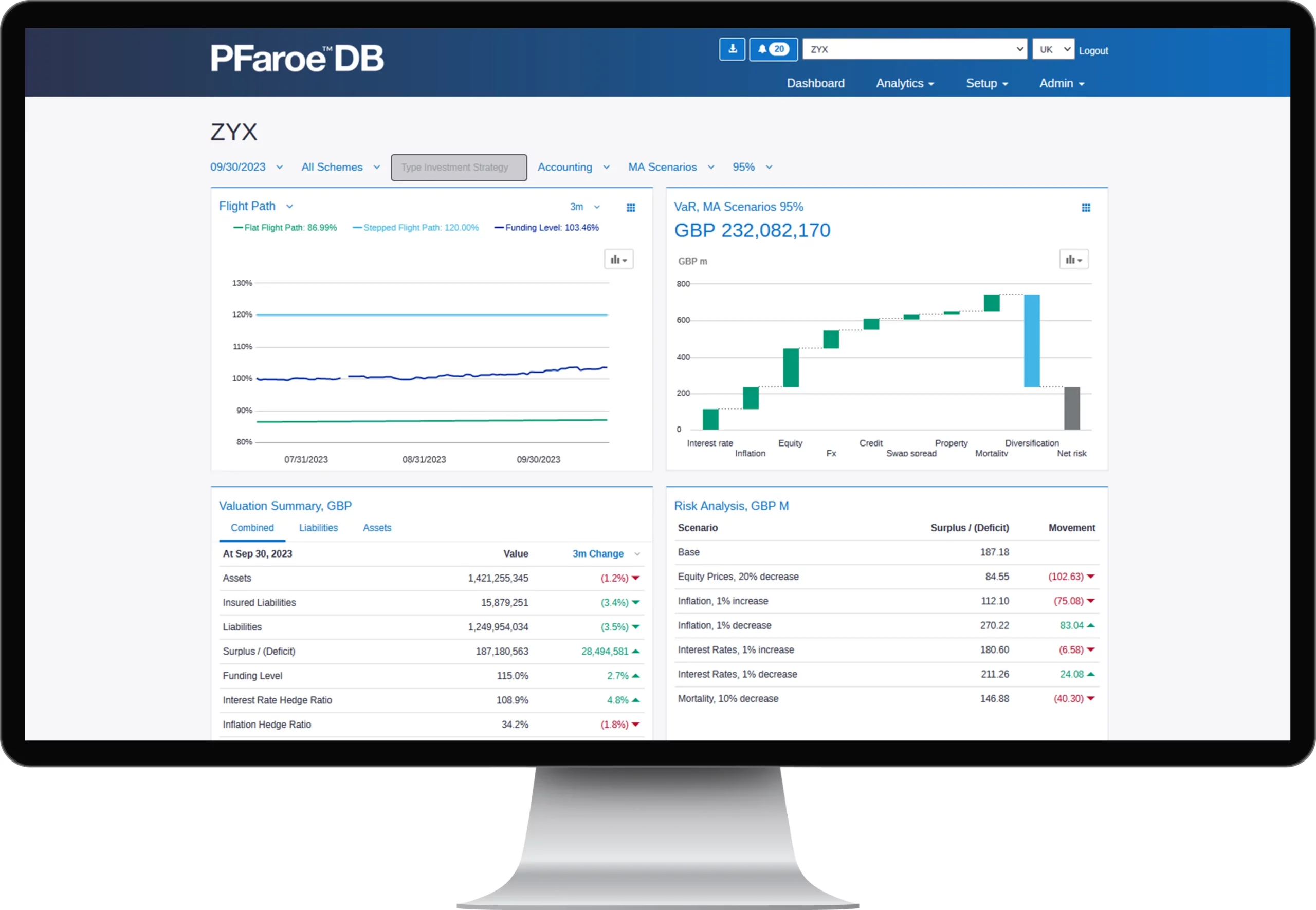

A comprehensive suite of pension analytics covering valuations, funding level monitoring, what-if scenario testing, risk analysis, ALM and reporting.

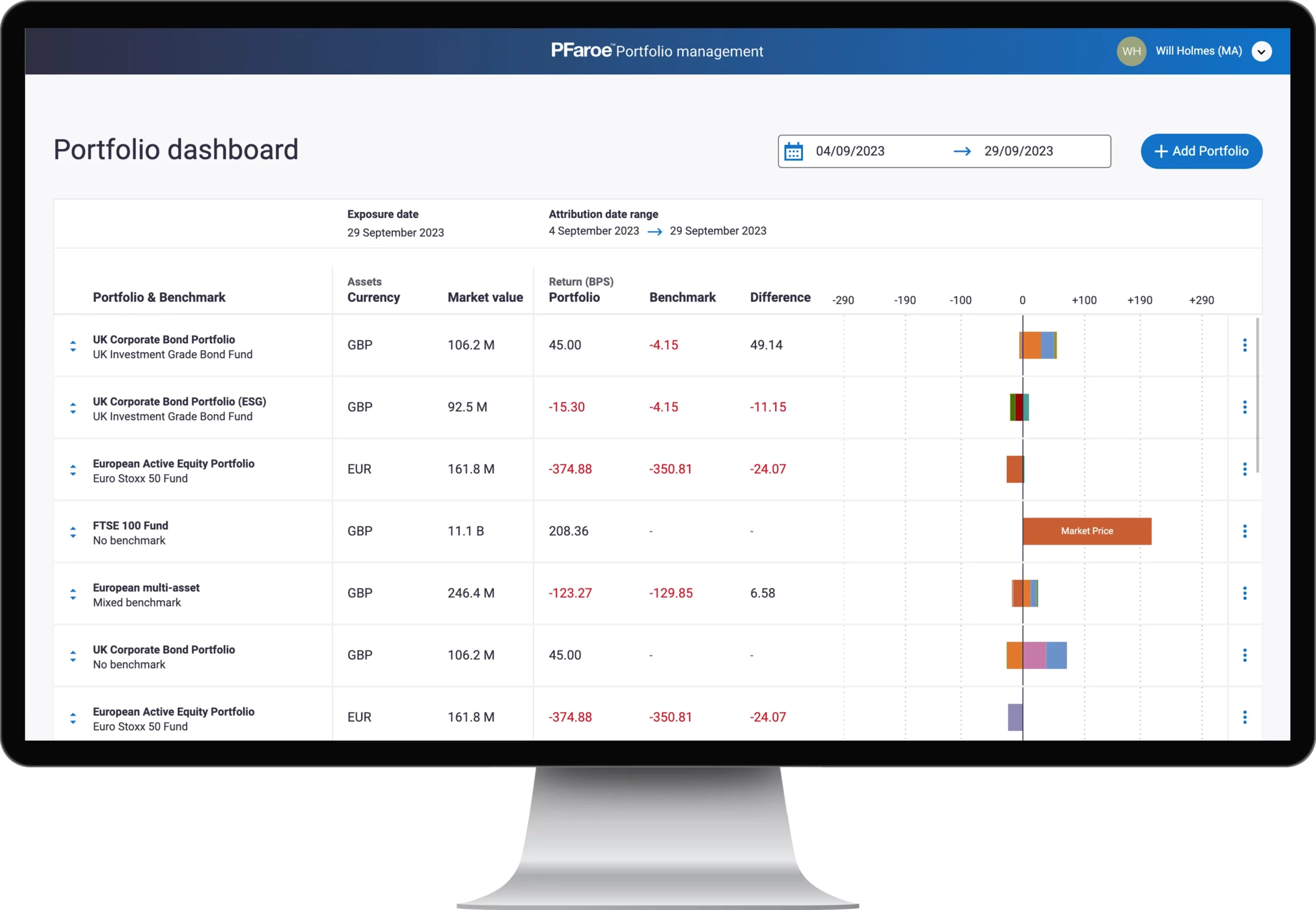

A flexible, intuitive, interactive and client friendly tool with powerful portfolio analytics to reveal your portfolio’s exposures, performance, ex-post, ex-ante risk plus an extensive list of rigorous and real-time portfolio analytics in a single place.

A dynamic tool that provides investment risk and simulation analytics for endowment or foundation portfolios with a focus on spending requirements and achieving mission objectives.

A flexible, interactive and user-friendly analytics and reporting tool that aligns investment solutions and asset allocation strategy with an insurer’s liabilities, planning objectives and risk profile enabling better decision making.

A systematic tool that helps retail funds/portfolios and DC funds conduct assessments to help meet their regulatory needs using portfolio risk, simulation analytics, forecast data and asset and liability analysis.

The pension strategy team at HSBC has been at the forefront of leveraging innovative technology to fortify risk management practices and drive optimization…

Read more

One of the world’s largest asset managers, State Street Global Advisors, adopted Moody’s PFaroe E&F to assess the impact of spending policies on investment… Read more

Today, we launched PFaroe Wealth, a user-friendly platform to enable wealth professionals to make better strategic asset allocation decisions, ensure.

Read more

Matthew Bale, Head of Product, Buy-Side Solutions at Moody’s Analytics joined Pensions & Investments to talk about some of the key product capabilities we are focus… Read more