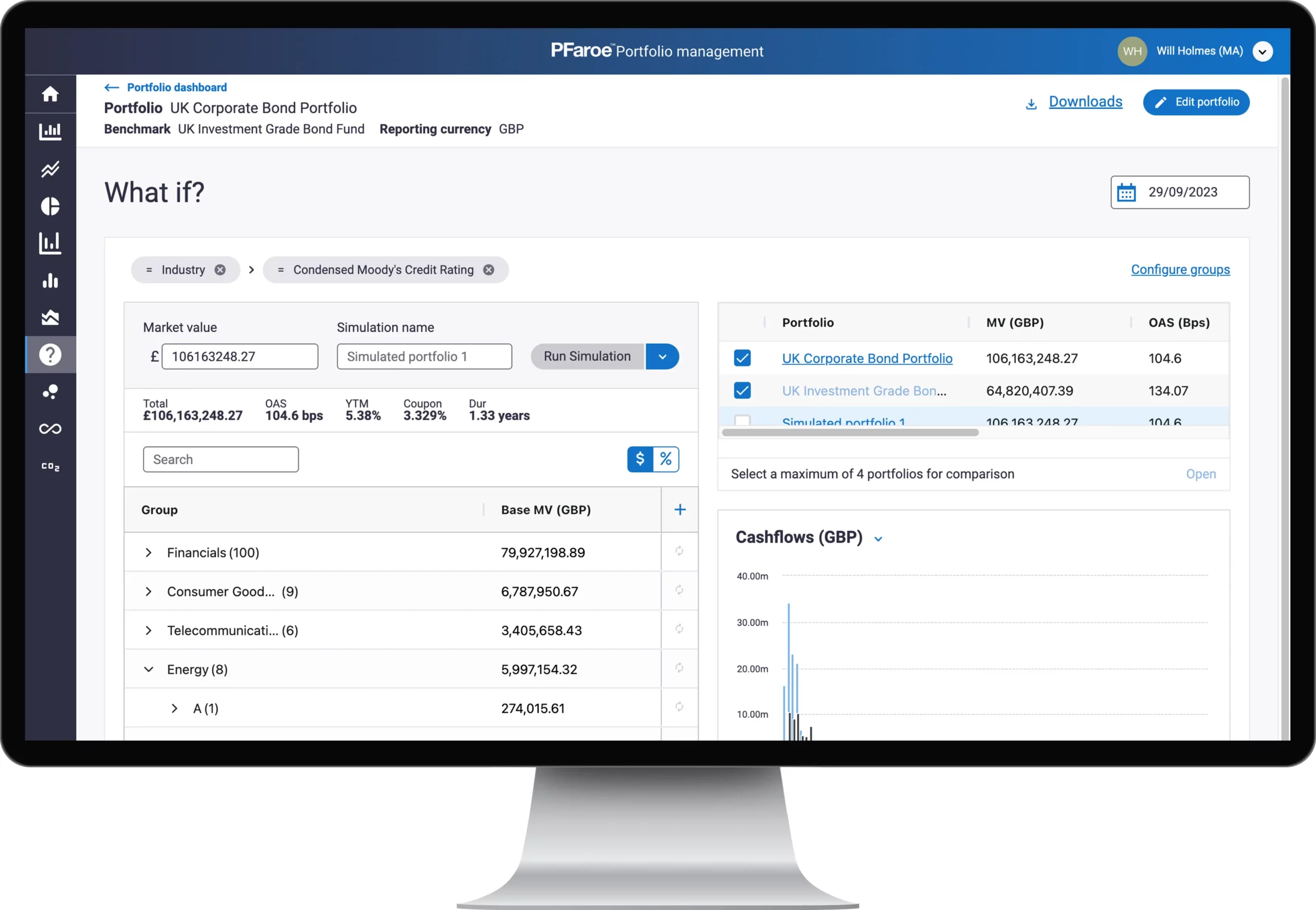

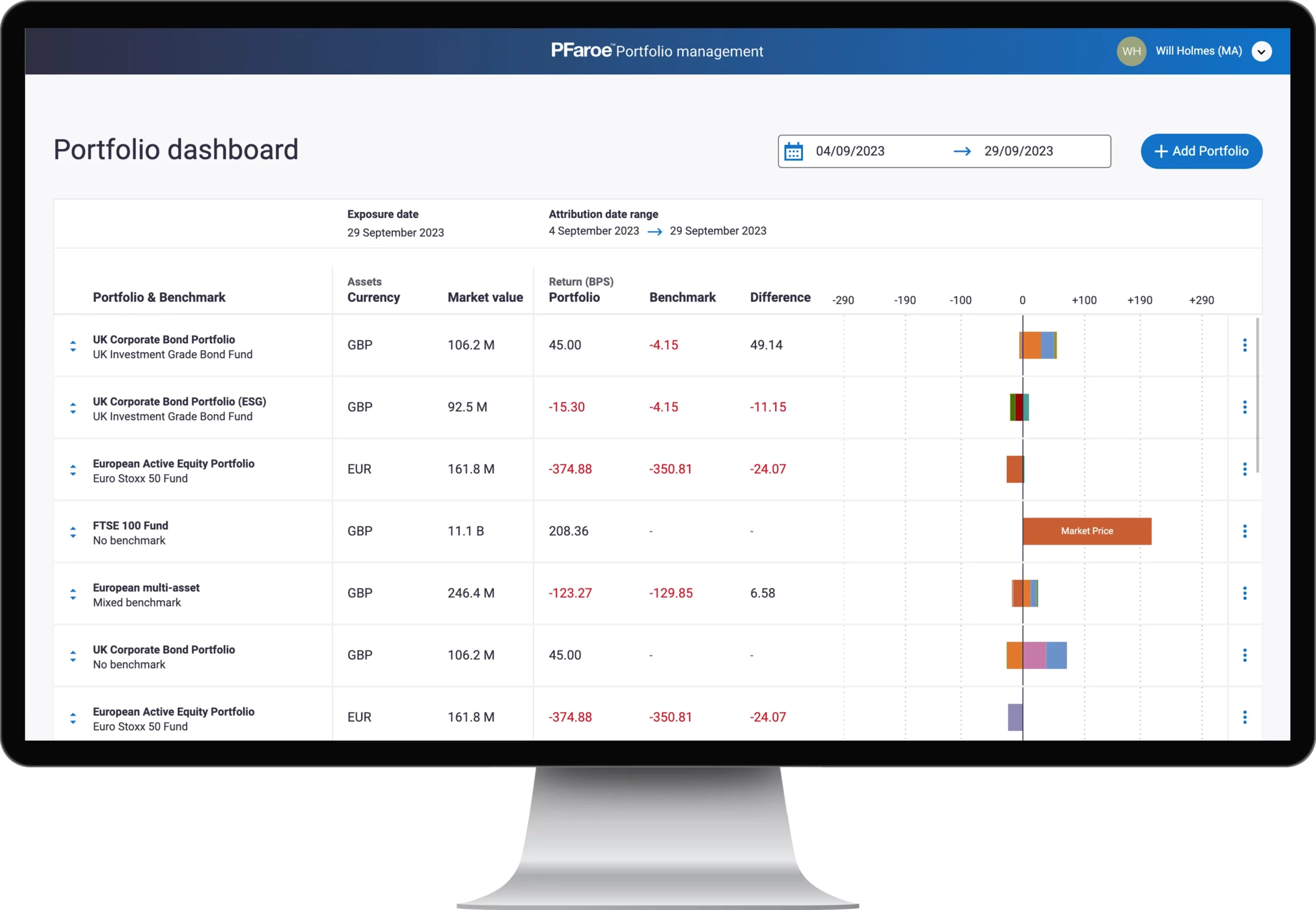

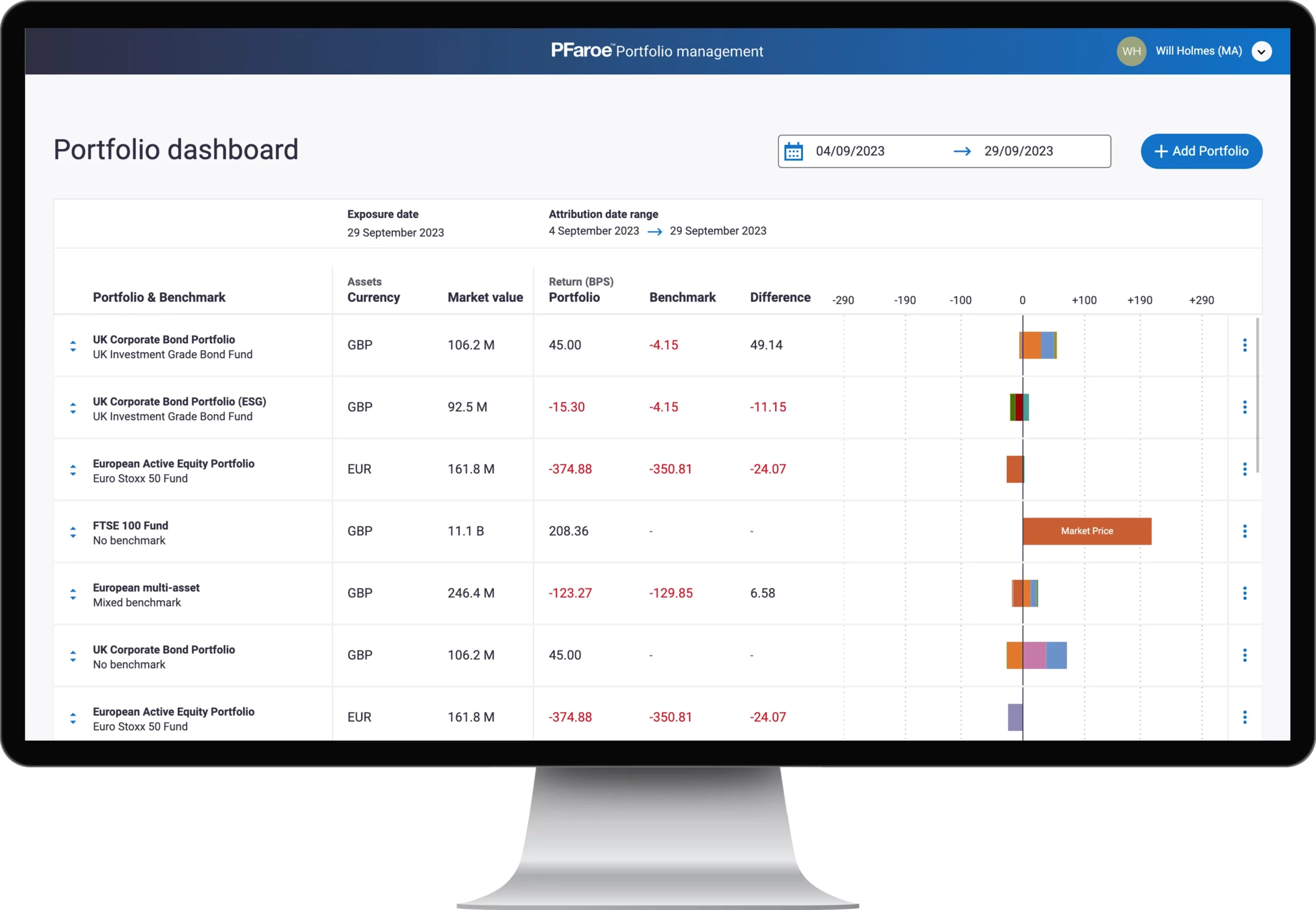

Perform performance attribution, Monte Carlo and historical risk analysis, and stress testing for multi-asset class portfolios with integrated market data, climate analytics, and ESG content.

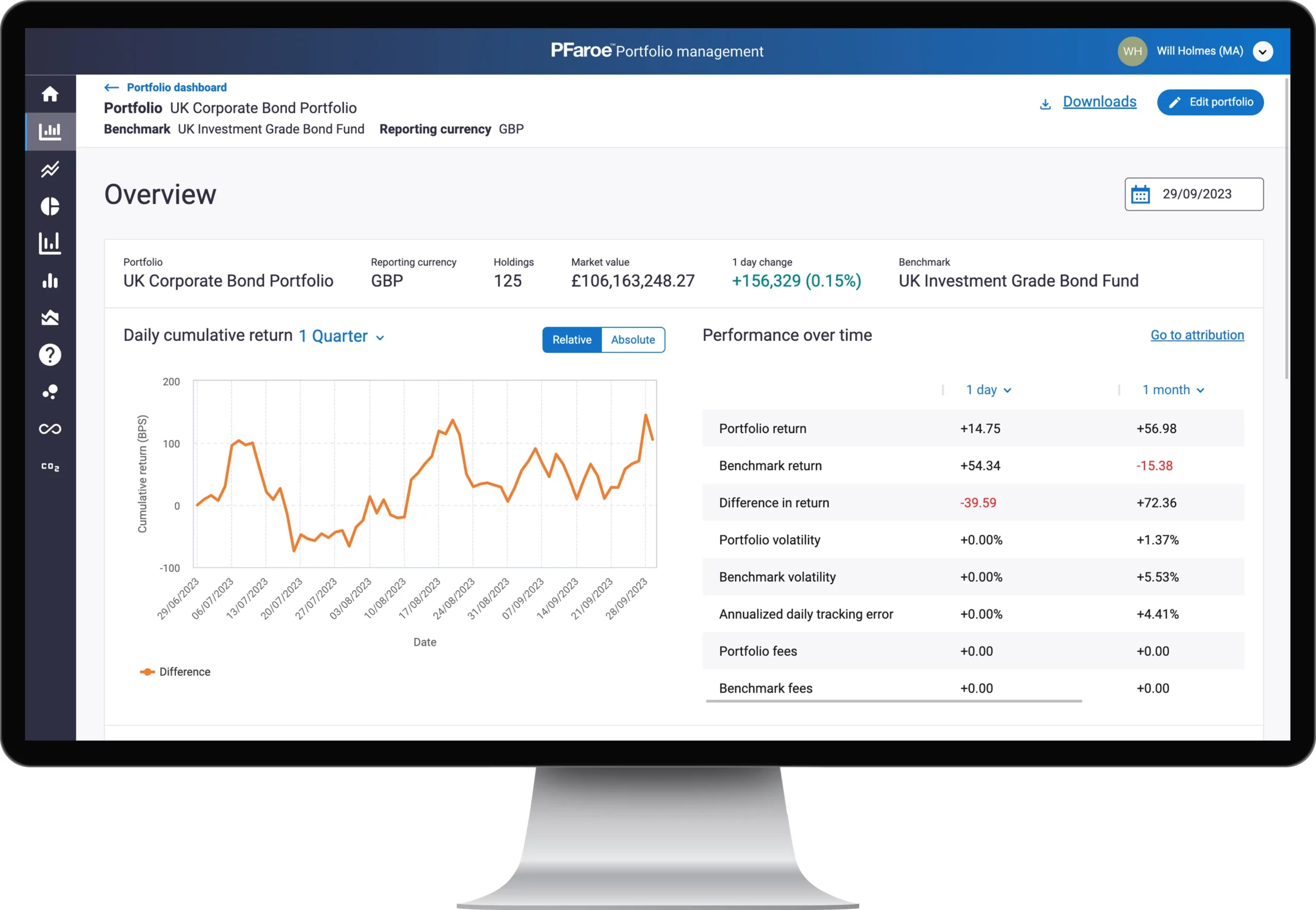

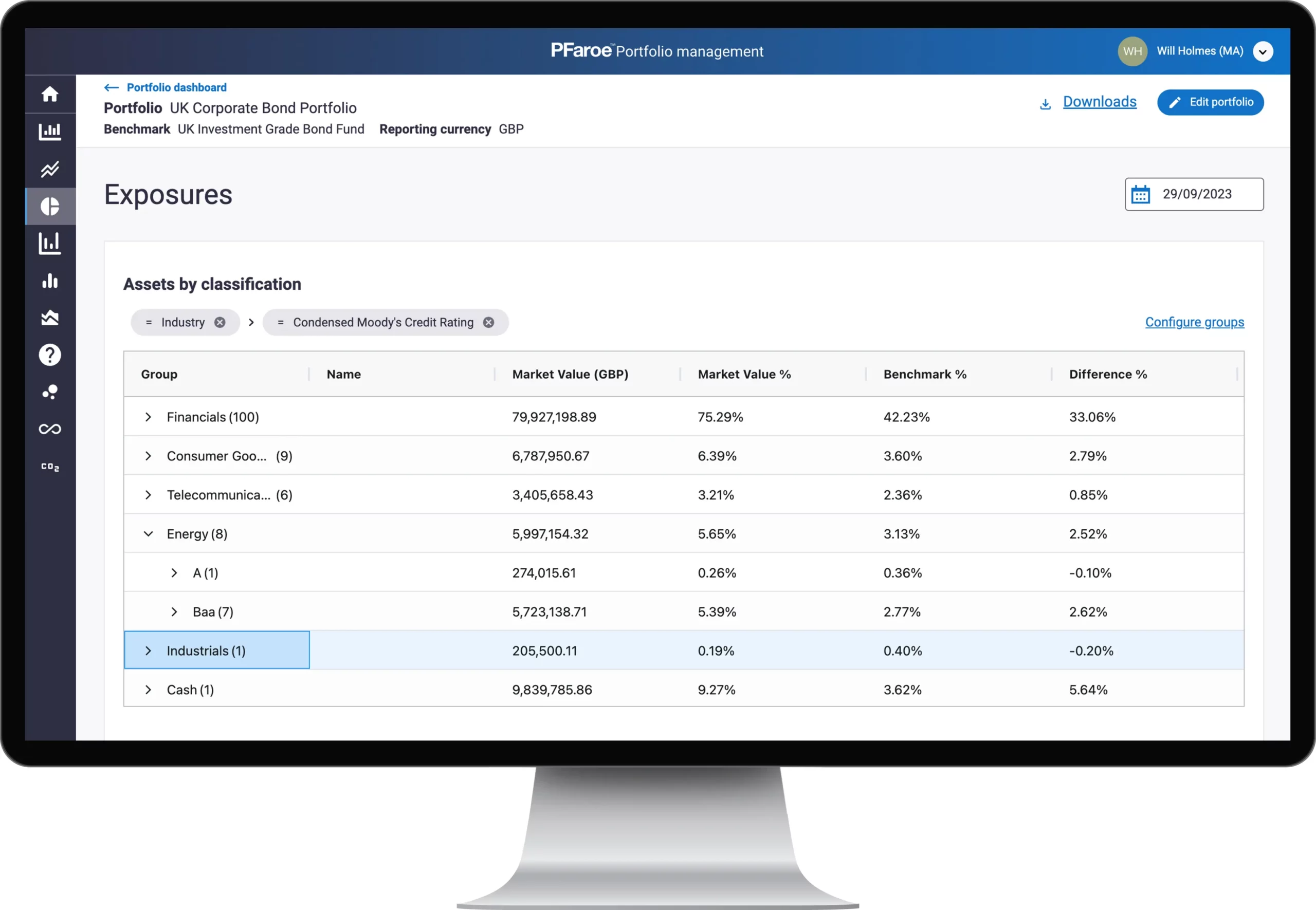

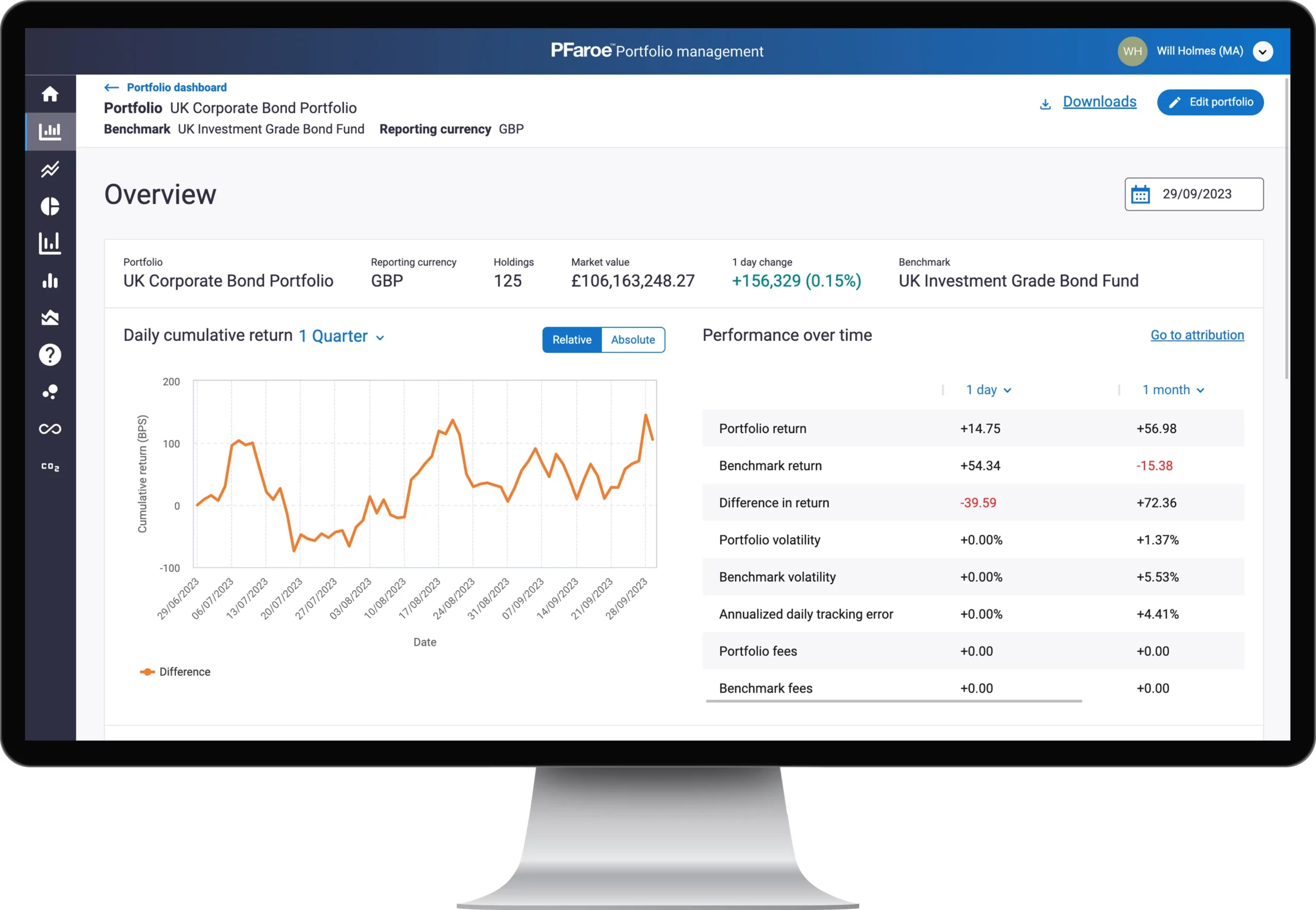

Transparency into an investment portfolio’s exposure, risk, and performance analytics for asset managers and their stakeholders.

Understand what makes PFaroe different. Test it for yourself. Contact us to schedule a one-on-one consultation with one of our experts.

The Real-World Scenario Generator contains stochastic asset models and calibration content that support realistic projections of asset returns and risk-factor distributions.

The CreditEdge platform provides a leading probability of default model for managing the credit risk of your portfolio of listed firms and sovereigns, globally.

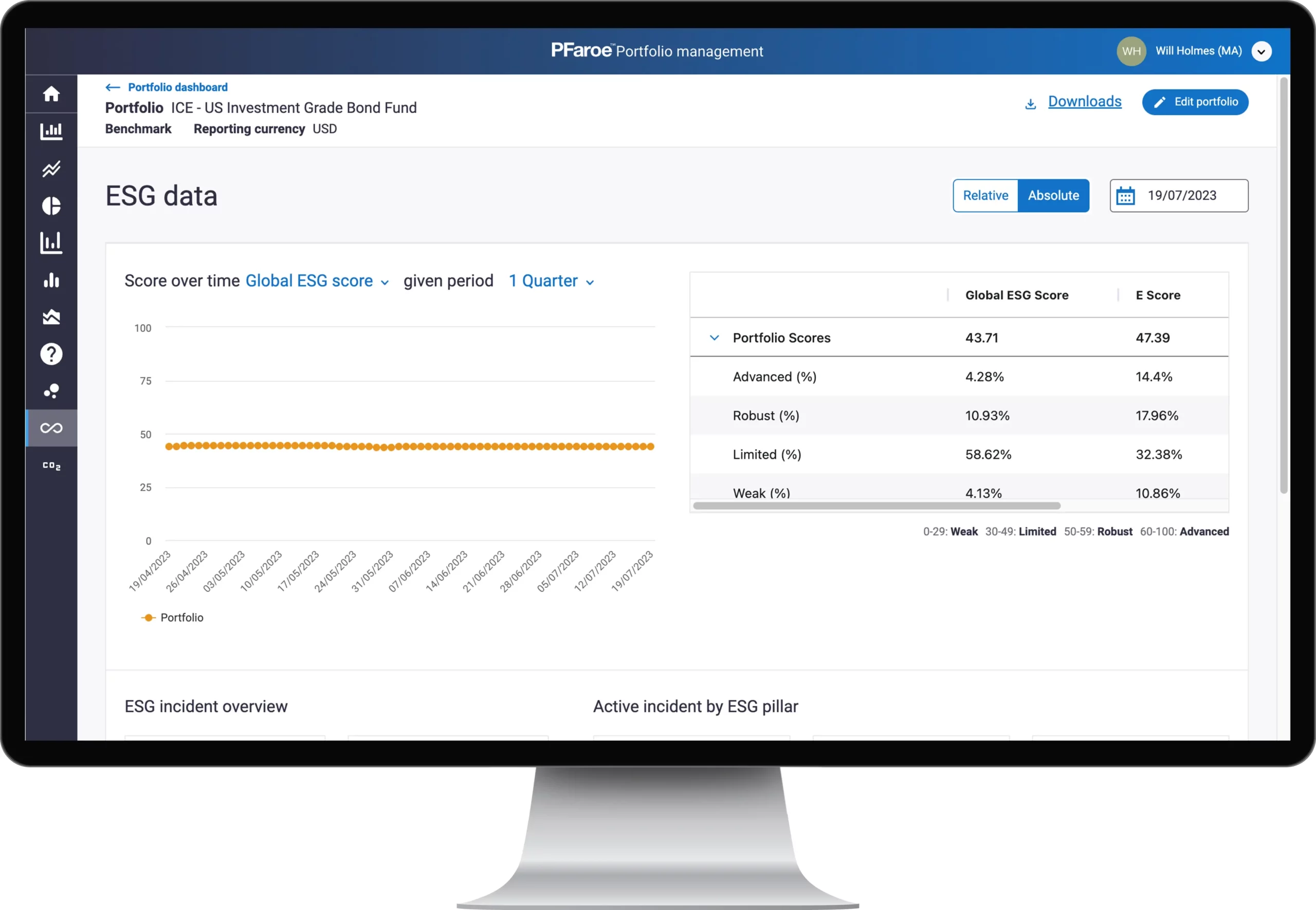

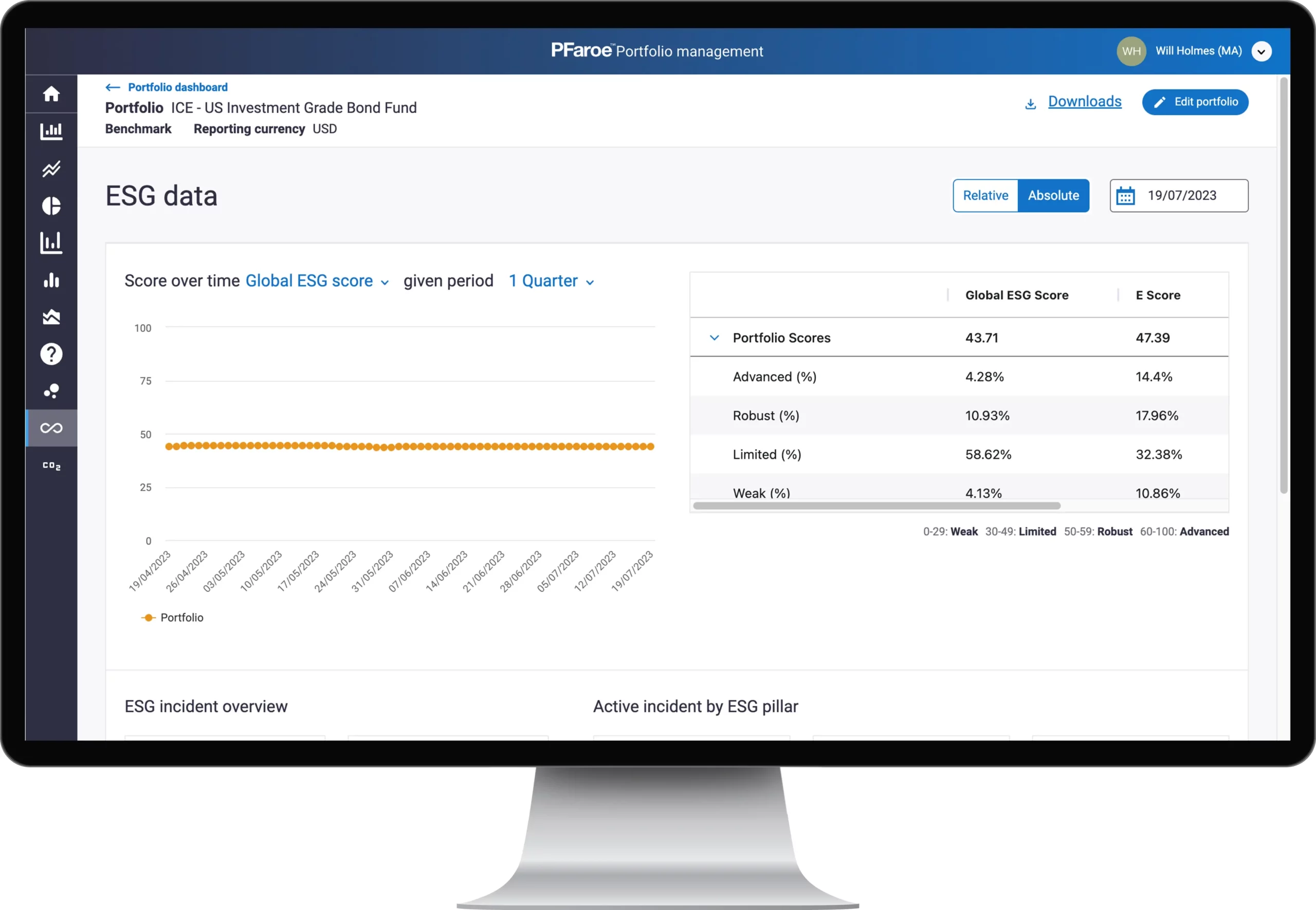

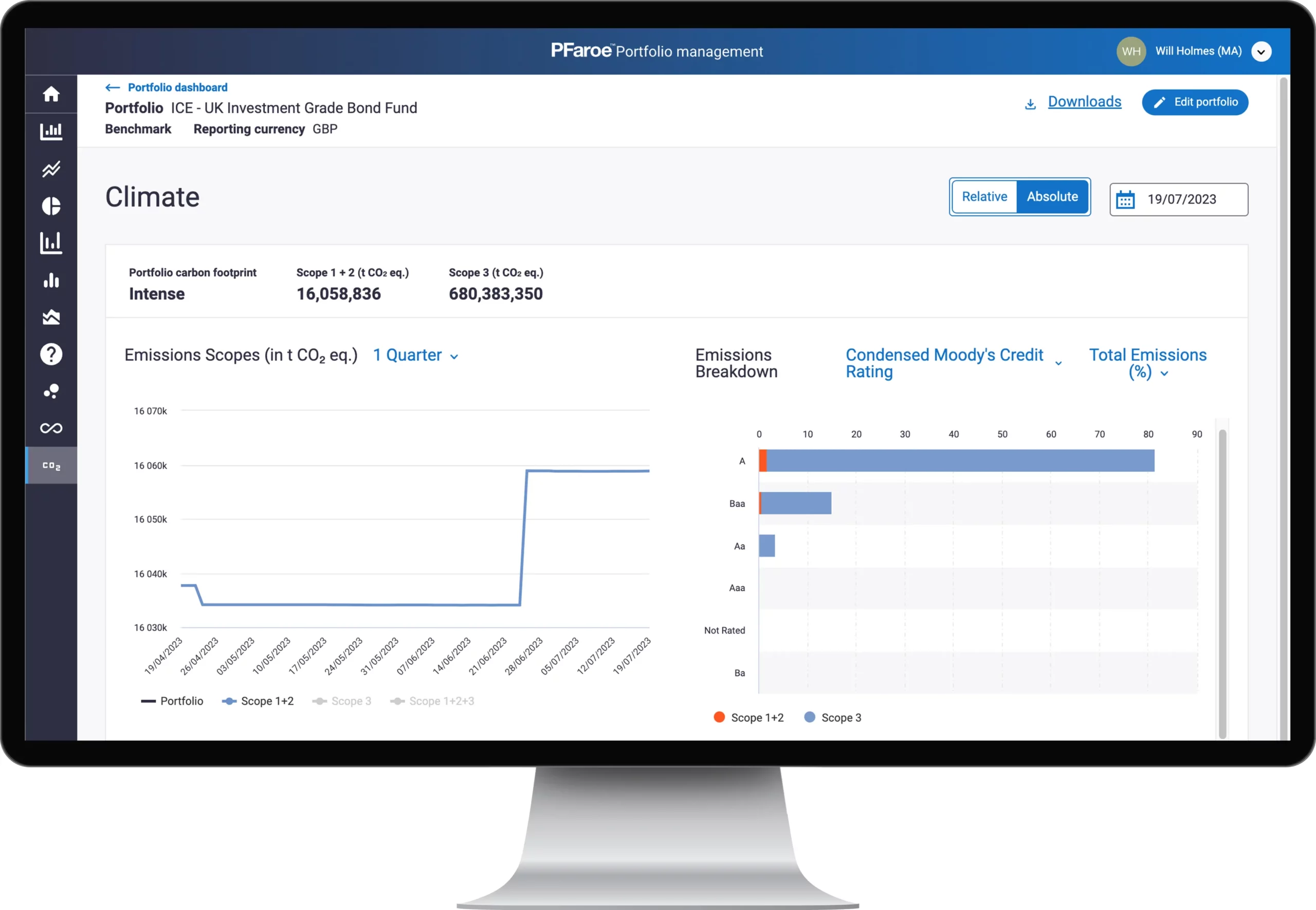

Sustainability and climate change are fundamental considerations to seize opportunities and manage risk in today’s global capital markets.

Risk Market Technology Awards - 2022

Winner

Risk Market Technology Awards - 2021

Winner

InsuranceERM Annual Awards 2021

Winner

Risk Market Technology Awards - 2020

Winner

InsuranceERM Annual Awards 2020 - Americas

Winner