PFaroe DB (Defined Benefit) for Public Pension Plans

- Amanda Flemming |

- Director of Customer Success, North America |

- MOODY'S

Navigating the Challenges of Public Pension Plans

Public pension plans confront distinct challenges ensuring they have enough resources to cover all promised benefits. These challenges stem from the risk of the plans not having enough money, which can happen due to lower-than-expected investment returns, longer lifespans, or insufficient funding.

Boards and advisors face challenges in terms of constructing asset portfolios, managing cashflows and achieving the right balance between funding and investment returns.

This white paper proposes leveraging PFaroe DB to tackle the outlined challenges facing public pension plans. With its advanced optimization tool, ALM modules, and risk analytics capabilities, PFaroe DB offers a comprehensive solution for enhancing pension plan management.

Optimizing Public Pension Plan Asset Allocations through PFaroe DB

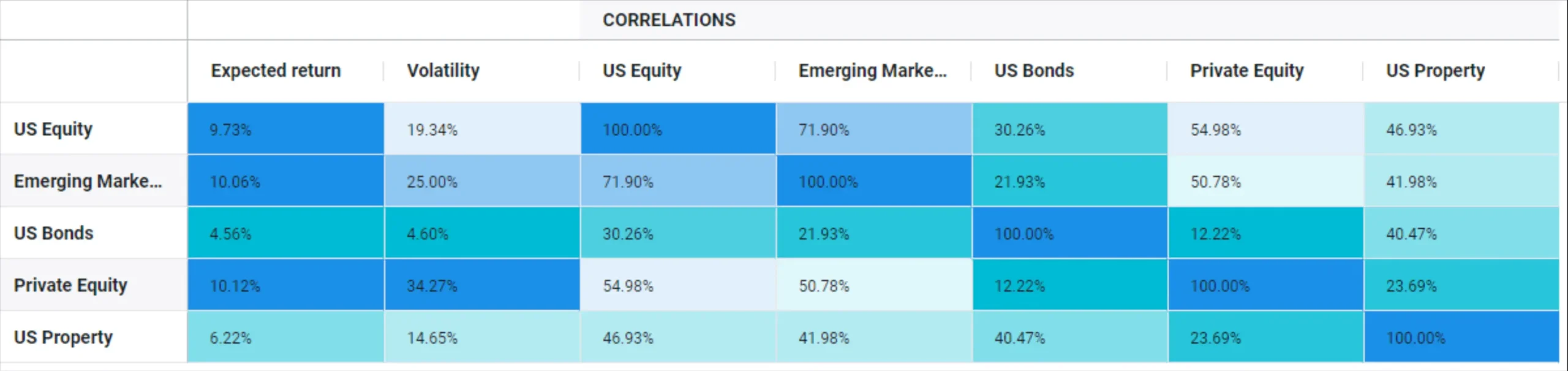

Portfolio optimization across a set of listed and private asset classes delivers a comprehensive solution for asset allocation and portfolio construction. Leverage Moody’s capital market data or integrate your own capital market assumptions, accommodating a tailored approach to forecasting and strategy development. Furthermore, the platform is developed with flexibility for different investment horizons, enabling strategic adaptability.

Users can access outcomes directly within the optimization tab, where they can explore various components such as efficient frontiers, detailed plan statistics, the distribution of asset allocation, and associated risks. Our tool enhances the optimization process by supporting various constraints, such as limits on funds and asset categories. Users can also specify relationships between different funds or asset types and control parameters based on plan objectives. This customization aids in aligning investment strategies with the investor’s goals and risk management standards, offering a strategic approach to asset allocation.

Predicting the Future of Public Pension Plans Using PFaroe DB’s Asset Liability Management Module

Regulatory Framework

The PFaroe DB ALM (Asset Liability Management) module has been significantly upgraded to offer a more sophisticated tool that aligns with the financial planning and risk analytics requirements of public plans. Central to these upgrades is the integration of the regulatory framework governing public plan funding.

The module allows users to customize the approach to actuarial calculation of contributions to each specific plan. This customization can involve choices in actuarial asset valuation methods, the definition of plan-specific amortization bases, the selection of approaches for calculating new amortization bases, and policies on contribution timing.

Moreover, the system permits the inclusion of additional funding policies in its projections, which can complement or act independently from the actuarially determined contributions. New metrics introduced in the module offer a detailed perspective on an entity’s financial well-being and its future commitments, providing valuable insight into its funding status, overall financial health, and risk profile over time.

The expansion of the platform to feature in-depth, audit-level outputs enhances transparency for users. This allows them to fully grasp the essential calculations that support the projection of smoothed asset values, the establishment of new amortization bases, and the requirements for actuarially determined contributions. These improvements are designed to furnish stakeholders with a thorough understanding of a plan’s financial standing, thereby enabling them to make informed decisions regarding the plan’s future financial well-being.

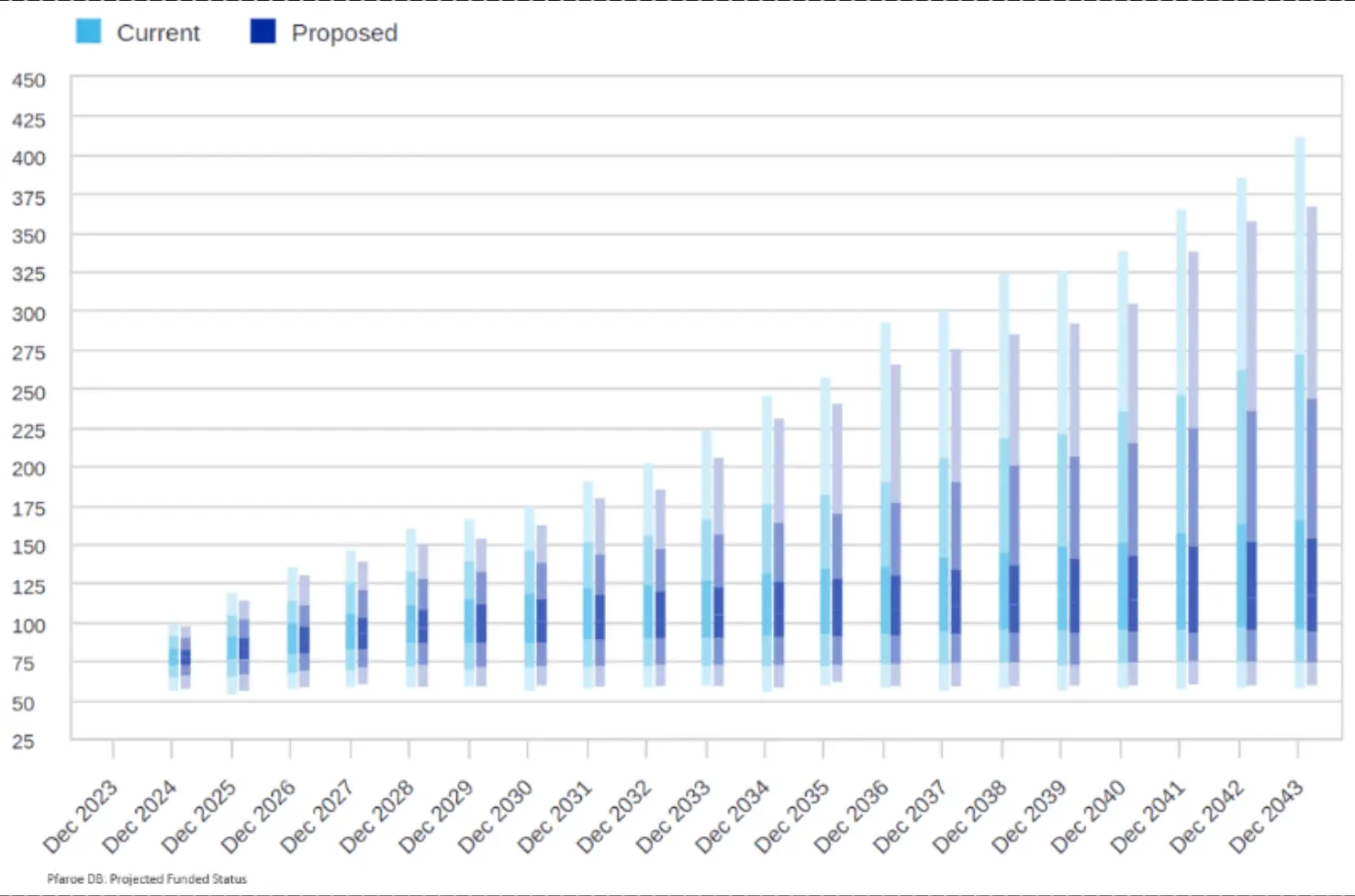

Longer Time Horizons

Public pension plans often find themselves at a funding disadvantage compared to their corporate counterparts. This highlights the importance of advanced ALM tools in ensuring the financial health and sustainability of these plans. The PFaroe DB ALM platform distinguishes itself through its advanced forecasting abilities, including both deterministic and stochastic models, enabling it to simulate financial scenarios for up to a hundred years. While the norm among our clientele is to project financial outcomes over a 20-year horizon, the platform’s versatility allows for a wide range of strategic explorations.

Central to the ALM platform’s utility is its ability to accommodate complex asset allocation models. This includes the integration of private investments, complete with nuanced considerations of varying vintage year drop-offs—a critical feature for plans looking to diversify their investment portfolios beyond traditional assets. Moreover, the platform enables users to experiment with different contribution strategies and adjustments to expected returns. This level of flexibility and depth in modeling provides public pension plans with a robust toolset to navigate their unique funding challenges, optimize their financial strategies, and work towards achieving a more secure funding status.

Private Allocation Strategies

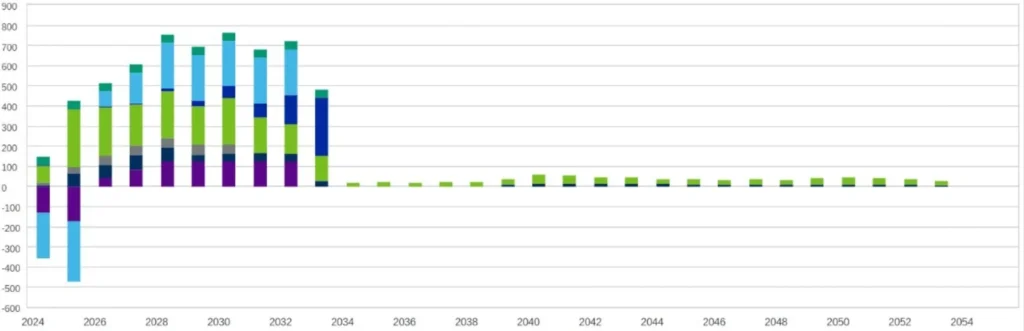

Building on the robust foundation of the PFaroe DB ALM platform, an enhancement has been introduced to further empower public pension plans in managing their portfolios. Recognizing the growing inclination towards alternative assets, particularly in the realm of private equity, where most of our clients allocate over 15% of their portfolios, the platform has evolved to offer an advanced modeling feature. This new development is designed to accurately reflect the cash flow profiles characteristic of such investments, notably the J-curve effect observed in the early years of private equity investments.

The J-curve phenomenon—where initial negative returns gradually give way to significant positive returns—poses a unique challenge in asset liability management and forecasting. The enhanced PFaroe DB ALM platform addresses this by providing a flexible framework that not only captures these distinctive cash flow patterns but also allows for the comprehensive inclusion of a range of illiquid assets. By integrating these complex dynamics into the projection models, clients gain a more nuanced and realistic view of their potential financial outcomes.

This improvement bolsters the platform’s utility for clients heavily invested in private equity and other alternative assets. It enables a more accurate assessment of how these investments contribute to the overall asset allocation strategy, considering their unique return profiles and liquidity characteristics. As a result, pension plans can make more informed decisions, aligning their investment strategies with long-term funding objectives and risk tolerance levels.

Summary

By offering a robust suite of tools, PFaroe DB empowers public pension plans and their advisers and asset managers to navigate the intricacies of financial planning and asset management. This enables them to effectively tackle investment complexities, thereby supporting the long-term sustainability and sufficiency of retirement benefits, securing a stable financial future for plan participants.

Get in touch

Visit https://pfaroe.moodysanalytics.com to learn how PFaroe DB can help you.