Increase risk-adjusted returns and deepen engagement with insurance clients, through a holistic view of investment risk

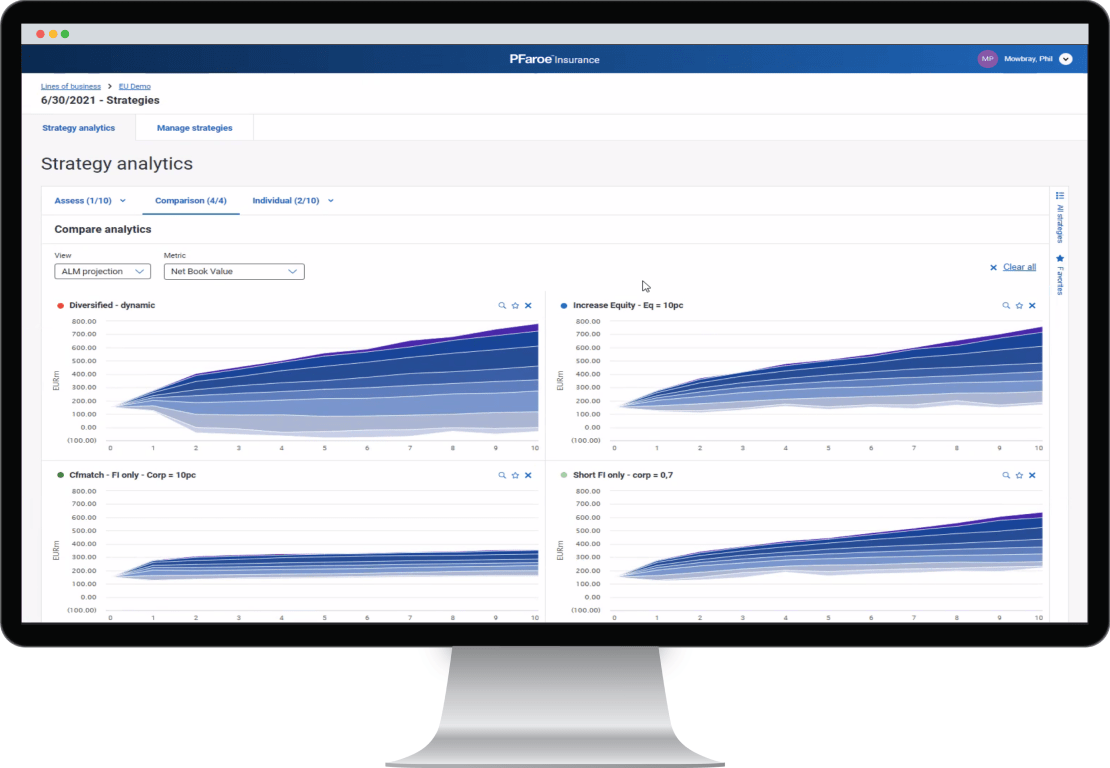

PFaroe’s advanced technology solutions deliver comprehensive analytics to meet the needs of insurers and their consultants and asset managers – enabling them to align investments with an insurer’s liabilities, planning objectives and risk framework. The tool facilitates cross balance sheet risk and ALM capabilities that deliver fast, intuitive and interactive analysis to support strategic asset allocation decision making.

Integrated analytics is delivered via a user-friendly and web-based interface. PFaroe Insurance enables consultants to deliver impressive and engaging pitches based on analysis of an insurer’s current investment portfolio, financial objectives and risk profile.

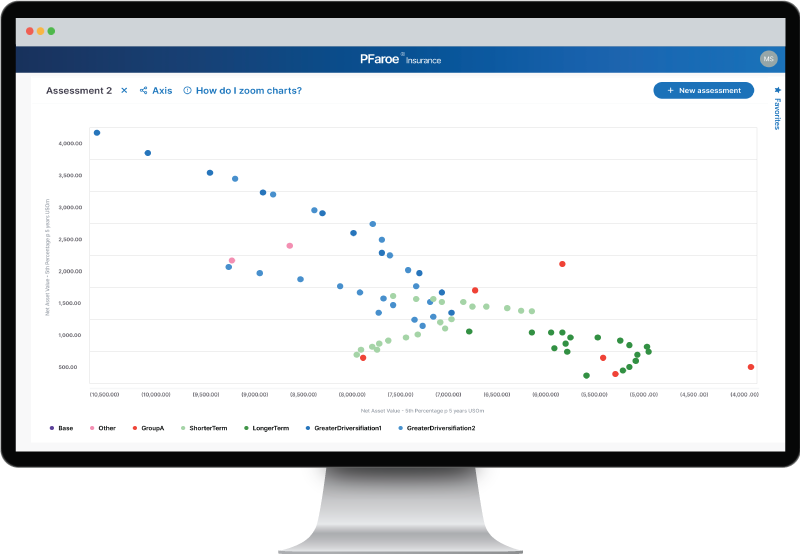

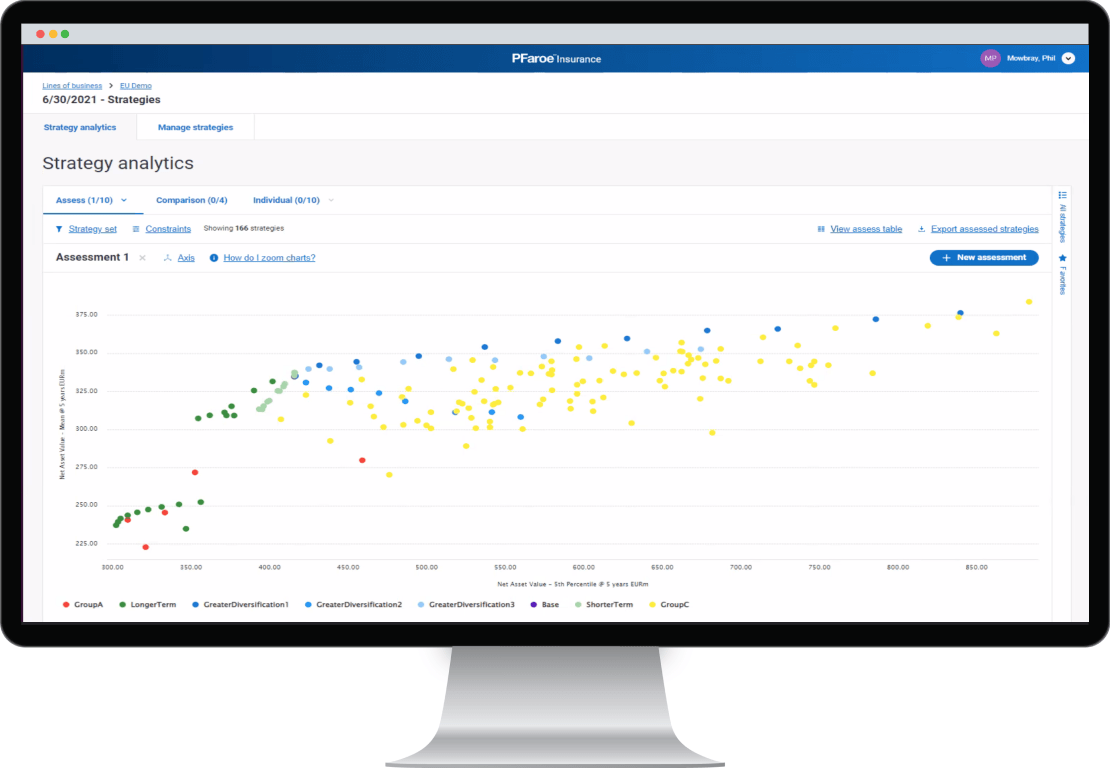

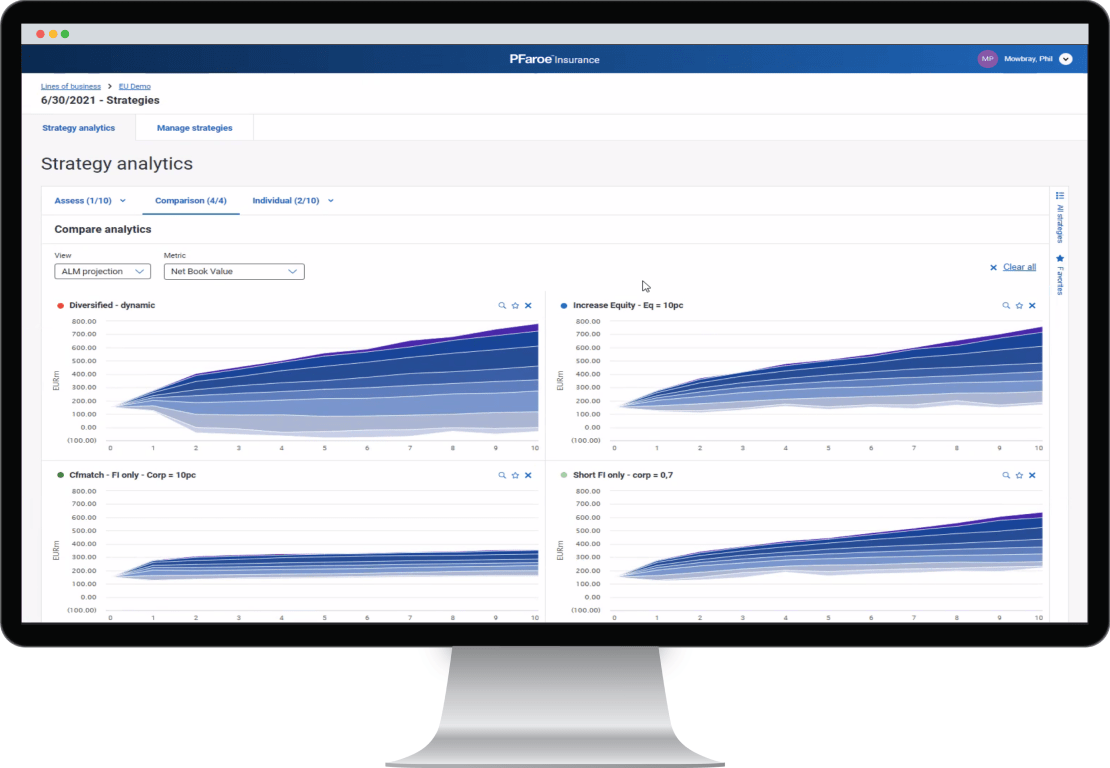

Consultants can discuss asset allocation and consider the impact of different investment strategies, employing a number of techniques from what-if scenario testing through to powerful stochastic modelling.

PFaroe’s easy-to-access yet sophisticated analytics allow consultants to improve how they communicate complex ideas to their clients.

Consultants are no longer burdened by maintenance of complex data, models and reporting, and can instead focus on providing value-added analysis to clients.

Reporting can be tailored and built into PFaroe, allowing for operational efficiency and promotion of the consultant’s brand.

Monitoring and reporting on portfolio risk, including impact of changes in the capital market environment, can be performed more frequently and seamlessly.

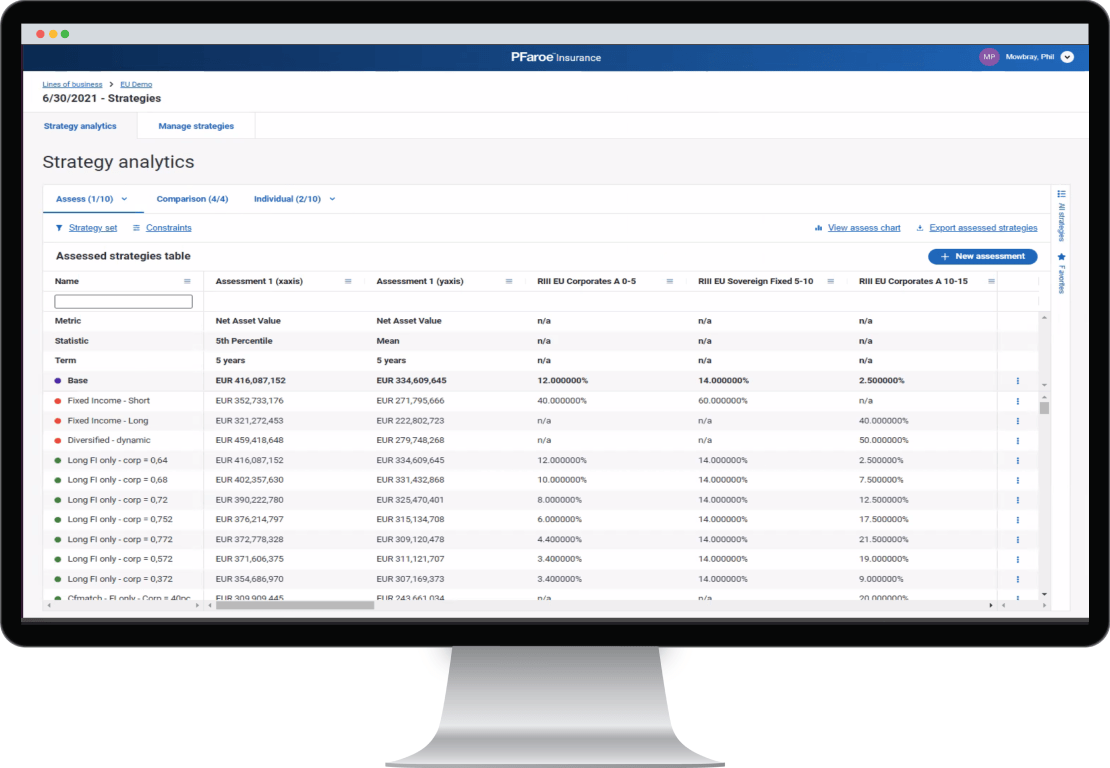

No investment allocation decision should be made in isolation. For insurers, that means understanding the impact of investment strategy on liabilities, accounting position and risk capital. PFaroe allows consultants to assess the impact of a change in the investment strategy not only on investment returns and risk, but across a range of metrics that represent the insurer’s planning objectives and risk profile.

PFaroe Insurance allows consultants to capture client liabilities within the assessment of different investment strategies or portfolio solutions. Asset analytics can be generated using benchmark assets, or an investment manager’s own funds. PFaroe automatically produces a comprehensive suite of liability, asset and risk analytics, allowing consultants to test solutions from multiple perspectives.

PFaroe empowers consultants to engage with insurance clients more interactively than ever before, providing on-demand desktop analysis of insurance portfolios and risk positions. Comprehensive ‘What if?’ functionality allows discussions and scenario testing in real time. PFaroe makes complicated concepts and analytics intuitive, leading to more informed clients with a desire for increased, and deeper, dialogue with their investment partners.

Clients can also be provided with direct access to PFaroe’s functionality, making reporting more efficient. This also drives a better appreciation of the link between investment solutions and insurance risks, giving insurers more comfort in making investment decisions more quickly and efficiently.

PFaroe’s modular functionality allows analytics to be tailored to the needs of each insurer.

PFaroe’s regular, easy-to-access analytics allow consultants to regularly test the effectiveness of risk management strategies, and work with clients in an interactive way to evolve solutions over time. User-friendly analysis dramatically increases the understanding and engagement of clients, and enriches the relationship.

The Real-World Scenario Generator contains stochastic asset models and calibration content that support realistic projections of asset returns and risk-factor distributions.

The CreditEdge platform provides a leading probability of default model for managing the credit risk of your portfolio of listed firms and sovereigns, globally.

Sustainability and climate change are fundamental considerations to seize opportunities and manage risk in today’s global capital markets.

Understand what makes PFaroe different. Test it for yourself. Contact us to schedule a one-on-one consultation with one of our experts.