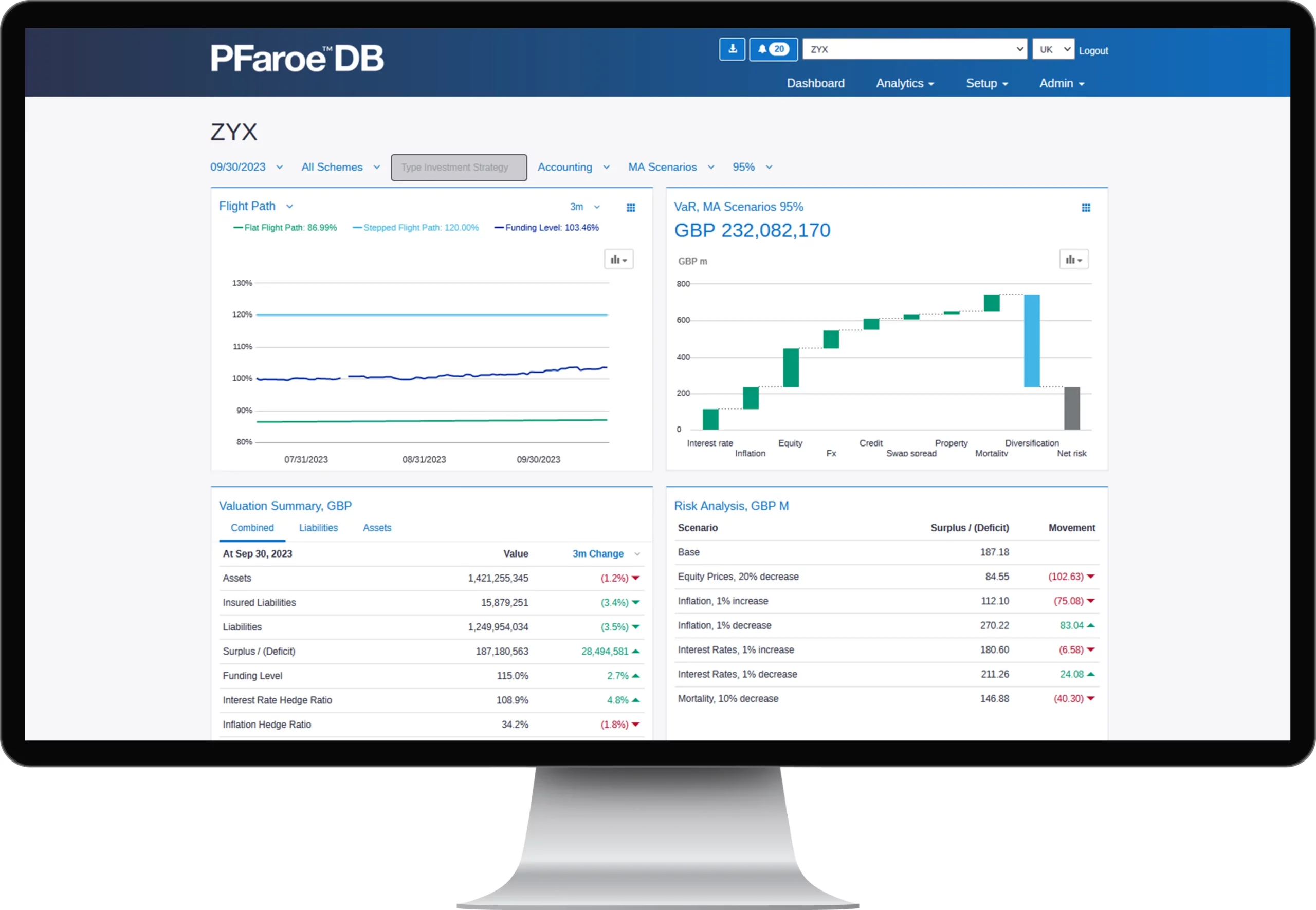

View valuations and risk analysis on the same screen, including funding levels, assets, liabilities and value-at-risk analysis.

PFaroe, as a central, consistent and shared information platform, drives more meaningful and interactive relationships between pension plan trustees, sponsors, actuaries, consultants and investment managers

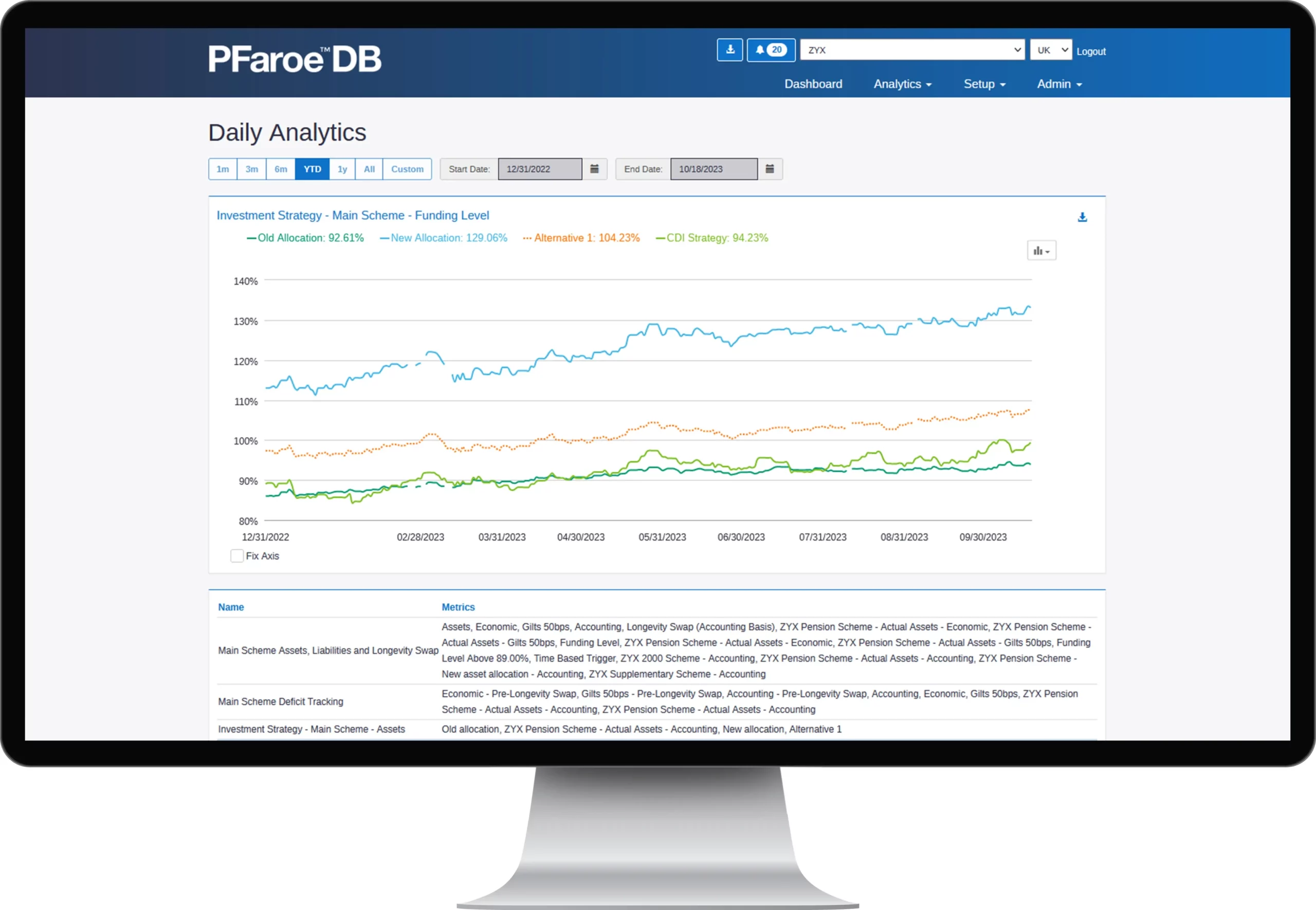

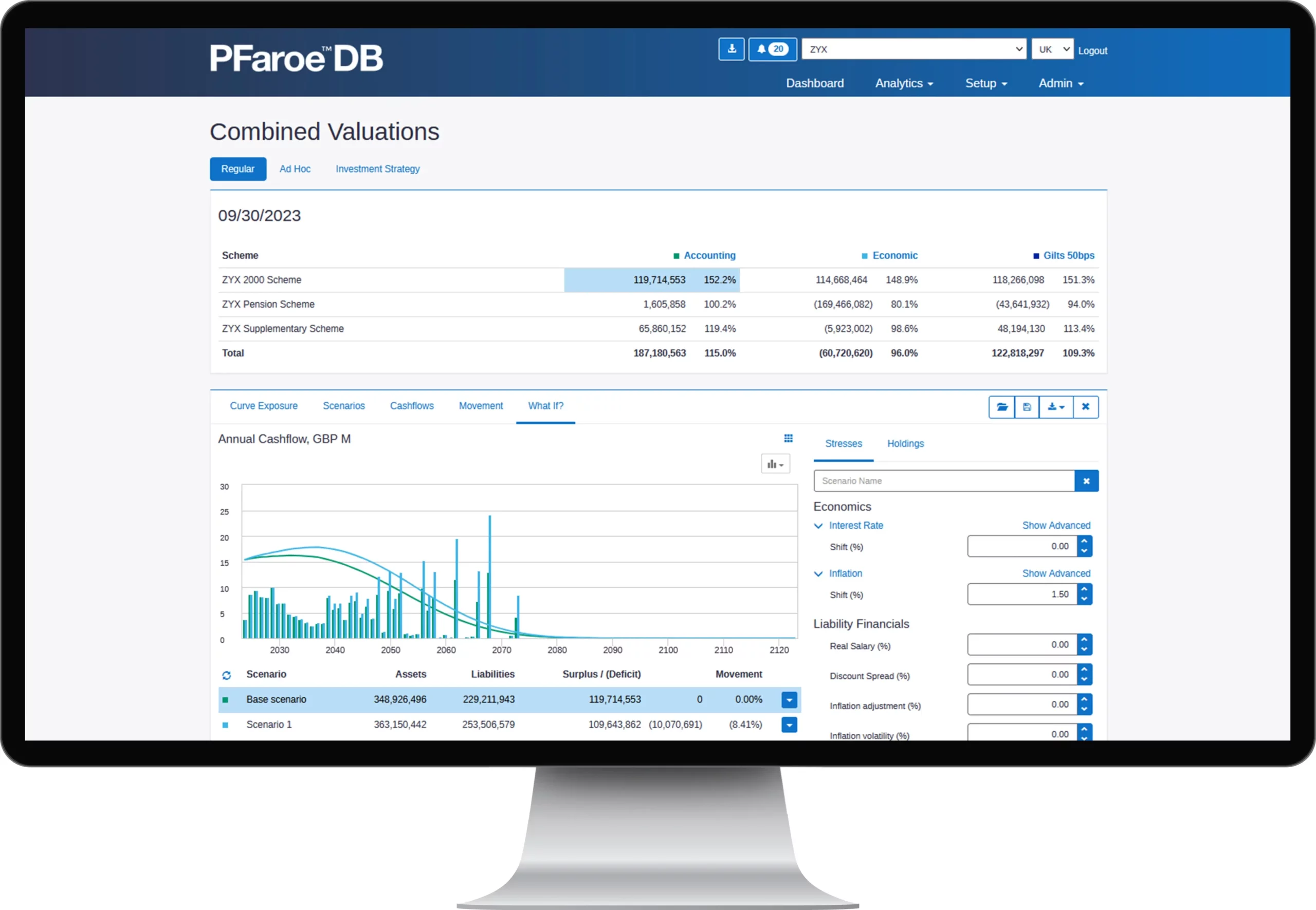

PFaroe allows users to change key assumptions, in real time, to test a range of outcomes. With an extensive range of risk metrics, it enables stakeholders to deepen their understanding of the plan’s risk exposure, ultimately resulting in better decisions.

Surprises are avoided through PFaroe’s transparent approach to risk management. A clear and easy-to-use interface helps users understand complex issues, while still delivering the detail required by sophisticated users.

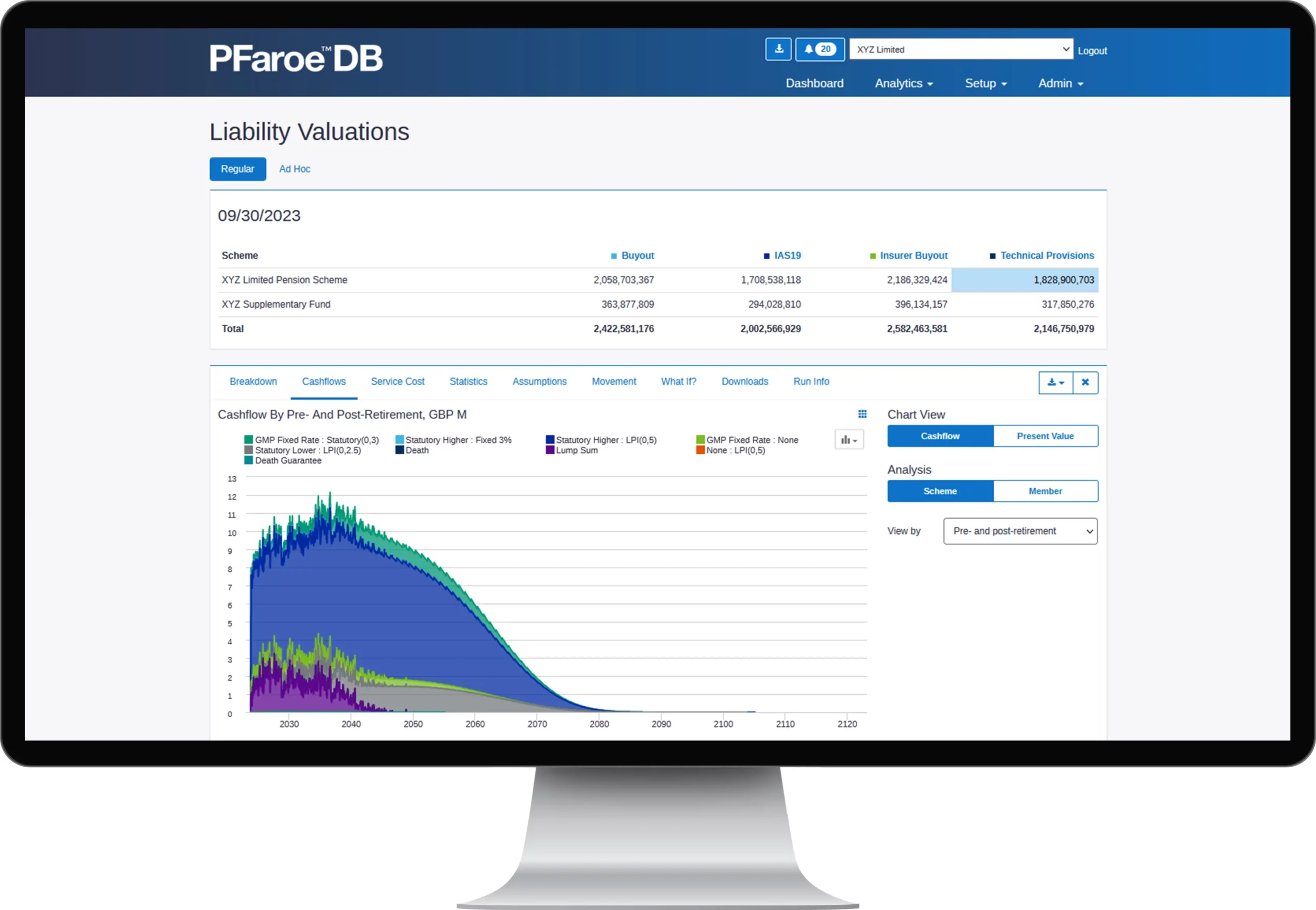

PFaroe allows plan sponsors to become increasingly self-sufficient, maximizing the use of internal resource when available. Plans can access information and test scenarios without having to rely on actuaries or consultants – they can even license the underlying valuation system to conduct full member-level valuations themselves.

Traditionally, pension plans have obtained asset, liability and risk information from multiple sources. PFaroe provides consolidated and consistent plan-specific information in one place for all stakeholders, driving consensus and improving the nature and relevance of discussions. Decision-making is informed and the effects of suggested actions can be tested in real time. Execute at the right time with confidence

PFaroe is often used as the focal point for meetings, moving the debate to one centered on results and actions rather than the accuracy of the numbers.

PFaroe liability valuation outputs are used to streamline accounting and other regulatory requirements. Clients in the financial sector can also save time and effort by using PFaroe to confidently satisfy their regulatory risk and capital reporting needs.

PFaroe has the flexibility to meet a broad range of reporting requirements. PFaroe’s Dashboard is designed to focus on key metrics for management discussions, while PowerPoint and Excel reporting enable standard or bespoke reports to be produced automatically.

PFaroe provides stakeholders with up-to-date funding, risk, and market information at their fingertips. Automatic notifications can alert them as to when triggers are hit, allowing plans to react more quickly and more confidently than ever before – seizing opportunities at the point market conditions change and de-risking options become compelling. Interact more efficiently with advisers and managers

PFaroe allows users to change key assumptions, in real time, to test a range of outcomes. With an extensive range of risk metrics, it enables stakeholders to deepen their understanding of the plan’s risk exposure, ultimately resulting in better decisions.

Surprises are avoided through PFaroe’s transparent approach to risk management. A clear and easy-to-use interface helps users understand complex issues, while still delivering the detail required by sophisticated users.

PFaroe allows plan sponsors to become increasingly self-sufficient, maximizing the use of internal resource when available. Plans can access information and test scenarios without having to rely on actuaries or consultants – they can even license the underlying valuation system to conduct full member-level valuations themselves.

Proper governance is essential to a well-managed pension plan and is the responsibility of all stakeholders. PFaroe ensures historic valuation and risk data is maintained and can be viewed and reported, on demand. This central repository helps plan sponsors to build the necessary controls to ensure they meet their governance obligations. Execute at the right time with confidence

PFaroe’s regular, easy-to-access analytics allow users to frequently monitor and review a plan’s position efficiently and effectively.

PFaroe allows the interrogation of different funding strategies, and allows plan stakeholders to work together from the same platform to determine which one is most suitable.

Understand what makes PFaroe different. Test it for yourself. Contact us to schedule a one-on-one consultation with one of our experts.

The Real-World Scenario Generator contains stochastic asset models and calibration content that support realistic projections of asset returns and risk-factor distributions.

The CreditEdge platform provides a leading probability of default model for managing the credit risk of your portfolio of listed firms and sovereigns, globally.

Sustainability and climate change are fundamental considerations to seize opportunities and manage risk in today’s global capital markets.