PFaroe enables investment managers to deliver impressive and engaging pitches via a user-friendly and web-based interface. This can even be done in a live client environment – in front of the investment board or CIO.

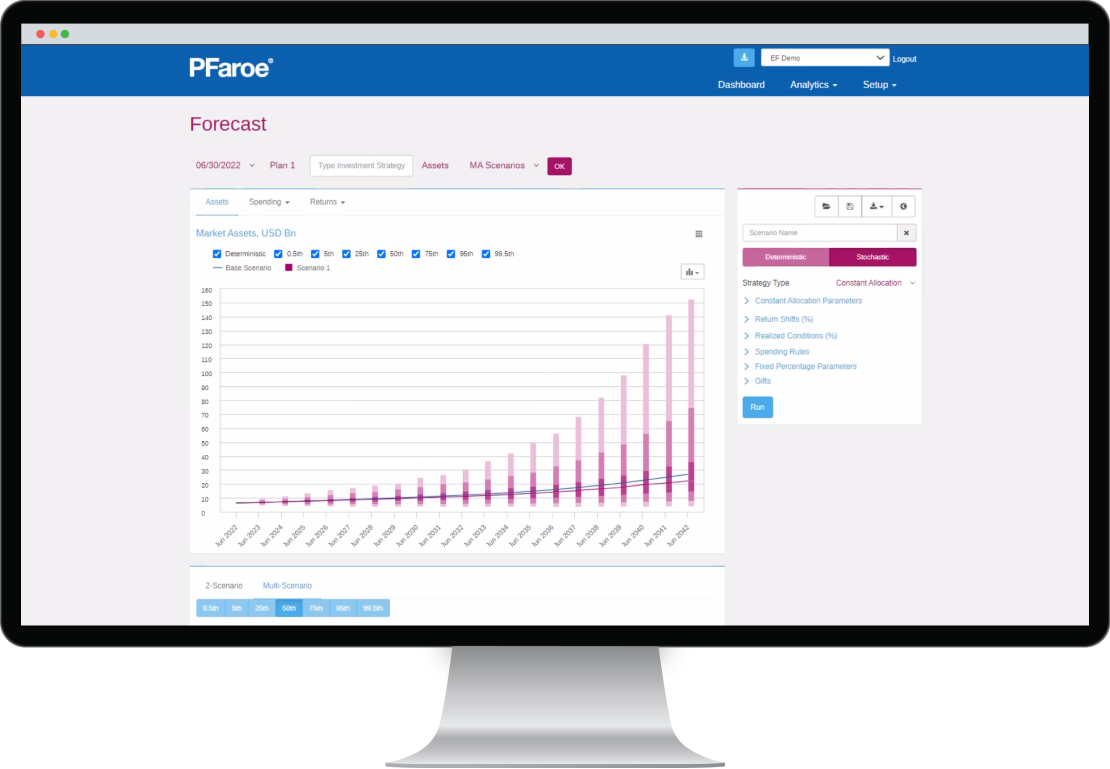

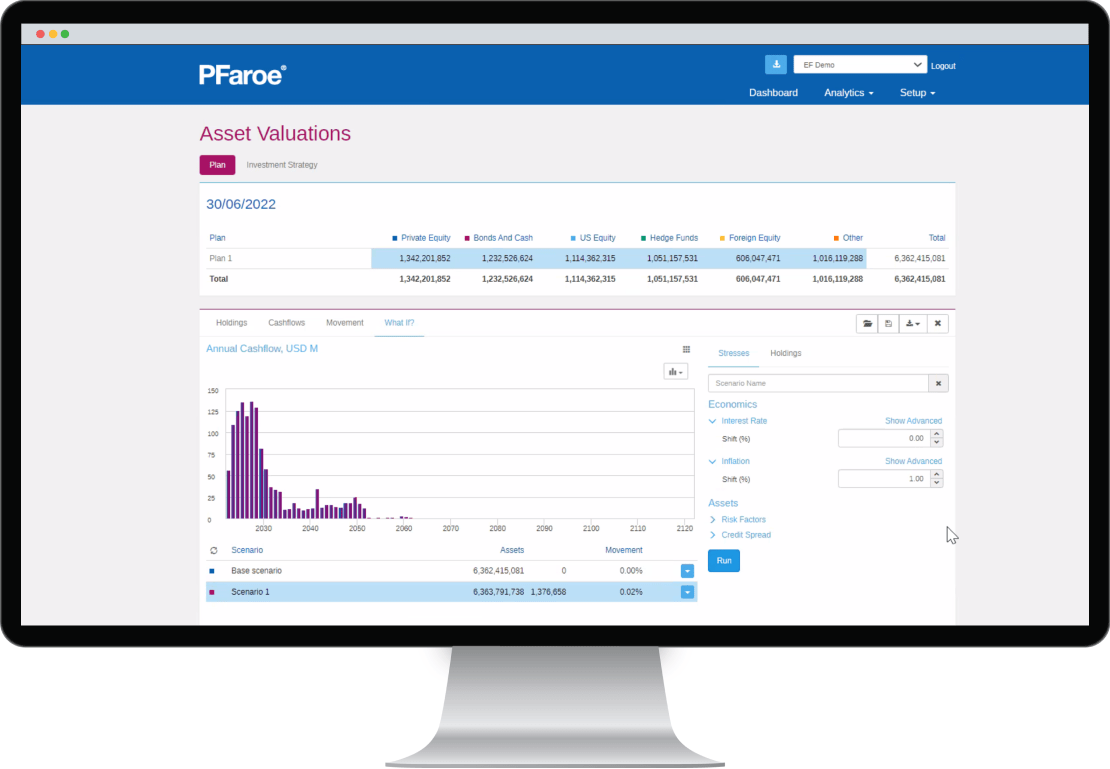

Investment managers can discuss asset allocation and consider the impact of different investment strategies, employing a number of techniques from “What if?” scenario testing through to powerful stochastic modelling using a sophisticated economic scenario generator.

PFaroe goes further than other technology options, allowing investment managers to model their proprietary pooled and segregated funds for inclusion in the analytics.

PFaroe shows the likelihood of endowments or foundations delivering on their mission through deterministic and stochastic projections of their portfolio’s spending contribution to the organization’s budget. The manager is empowered by illustrating the direct impact of investing in their own suite of funds on these financial goals. The client sees the practical implications of the theory.

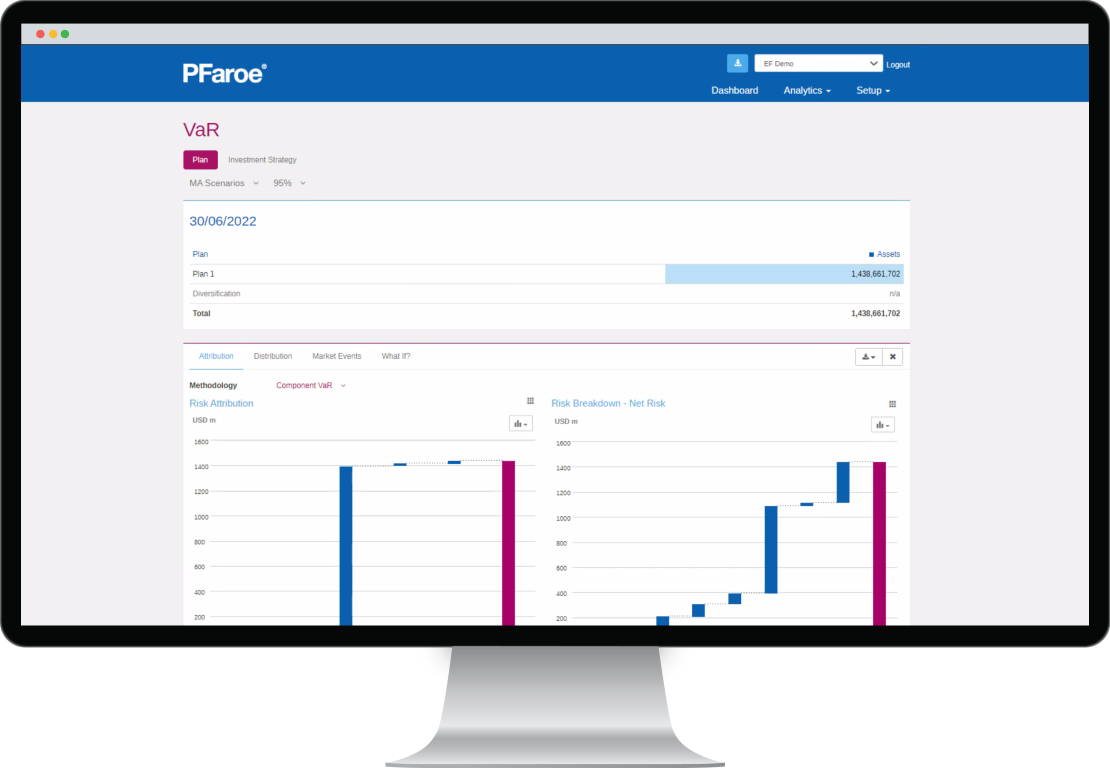

No investment allocation decision should be made in isolation. For endowments and foundations, that means understanding the impact of investment strategy on spending objectives.

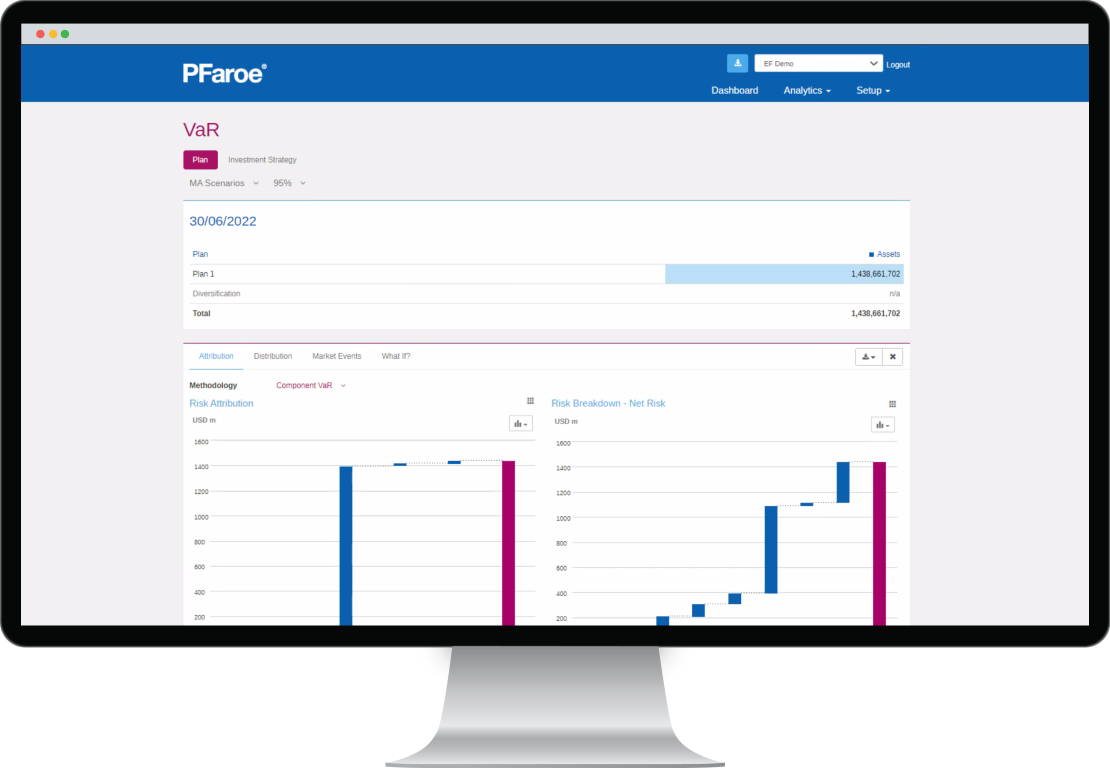

Within PFaroe, asset analytics can be generated using benchmark assets, an investment manager’s own promoted funds and/or from assets modeled at a security level (position level risk). Alternatives are included for a holistic view of the portfolio. Multiple types of spending formulae are built in, which, together with the asset inputs, automatically produce a comprehensive suite of spending liability, asset and risk analytics, allowing investment managers to interrogate and test investment solutions from multiple perspectives. The dialogue with the client is enhanced.

In formulating investment hypotheses, implementation of the advisor’s capital markets assumptions enhance the overall value proposition. Results are consistent across all institutional types and sizes.

PFaroe’s regular, easy-to-access analytics allow investment managers and their clients to monitor and report on an organization’s investment portfolio and risk efficiently and effectively. It also allows investment managers to regularly test the effectiveness of their investment strategies, and work with clients in an interactive way to evolve solutions over time.

User-friendly analysis dramatically increases the understanding and engagement of clients, and enriches the relationship.

PFaroe’s reporting capabilities are powerful and comprehensive, providing a potential platform for front-to-back reporting needs. PFaroe can generate client-ready reports, either for pitching to new business or for monthly/quarterly trustee reporting requirements, on-demand at the click-of-a-button.

Given PFaroe’s established market presence, its network of users can be used as a means to “get the word out” about an investment manager’s established pooled and segregated asset solutions. For instance, the manager can choose to make their fund offerings available to the many investment consultants using PFaroe, who in turn can illustrate the effectiveness of those solutions to the end-user endowment and foundation.

With PFaroe, a joint proposition between the endowment and foundation, investment consultants, and investment managers is a compelling possibility.

PFaroe’s easy-to-access yet sophisticated analytics allow investment managers to improve how they communicate complex ideas to their clients. Reporting can be tailored and built into PFaroe, allowing for operational efficiency and promotion of the investment manager’s brand. Investment managers are no longer burdened by report preparation and number-crunching, and can instead focus on providing value-added analysis to clients.

Monitoring and reporting on portfolio risk and spending implications can be performed more frequently and seamlessly.

These efficiencies make it economically viable for investment managers to provide more tailored solutions to a wider range of clients, including smaller endowments and foundations. Disparate systems and services can be rationalized through implementation of PFaroe, saving time and money, while manual intervention is eliminated, improving security and minimizing the risk of errors.

The Real-World Scenario Generator contains stochastic asset models and calibration content that support realistic projections of asset returns and risk-factor distributions.

The CreditEdge platform provides a leading probability of default model for managing the credit risk of your portfolio of listed firms and sovereigns, globally.

Sustainability and climate change are fundamental considerations to seize opportunities and manage risk in today’s global capital markets.

Understand what makes PFaroe different. Test it for yourself. Contact us to schedule a one-on-one consultation with one of our experts.