Success story: globally-renowned asset manager uses PFaroe to improve E&F management

The business case

The client was aiming to obtain a holistic view of a variety of risks within portfolios in an efficient and robust manner using a comprehensive risk management solution. Especially in an era of heightened geopolitical risk, inflation uncertainty, and interest rate volatility the demands on SSGA to help its E&F clients to meet their respective missions with a sharper focus on managing risk exposures against returns expectations has become more complex. Prior to adopting PFaroe E&F, the risk management process included the use of multiple tools and some manual processes causing operational inefficiencies.

PFaroe E&F provided an all-inclusive risk analytics and asset allocation platform to reduce inefficiencies and provide the enhanced visibility required by their clients and overall governance framework. Another key requirement was for more robust spending analyses, which for SSGA are crucial inputs into asset allocation and portfolio construction decision-making. These studies take a deep dive into the endowment or foundation’s past, current, and projected , as well as associated returns, costs and desired capital outlays – to ensure assets are allocated in an effective and sustainable way.

The solution

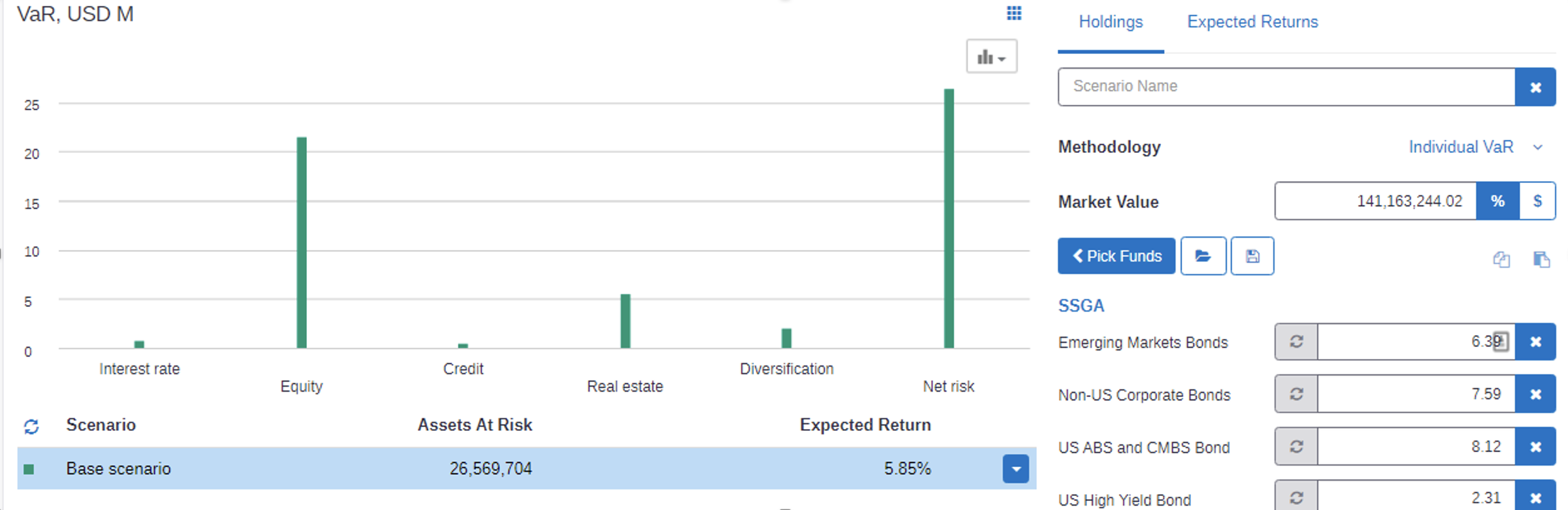

By leveraging PFaroe’s machine learning algorithms and data visualization techniques, SSGA has been able to optimize its asset allocation recommendations and better educate clients on their likelihood of achieving desired outcomes.

Aside from running spending study analysis, PFaroe E&F has also helped SSGA perform scenario analysis – simulating various market conditions and crisis events to see how investments would perform under different scenarios and how potential portfolio allocations could best meet their spending requirements.

Thanks to the system’s cutting-edge analytics, and advanced capabilities designed specifically for E&F needs, SSGA has been able to:

- Identify previously hidden patterns and trends – which has vastly improved its understanding of potential risks and opportunities.

- Gain a more granular understanding of the risks and opportunities associated with investment decisions

- Make more informed asset allocation decisions, structure better solutions, and strengthen new business proposals

- Increase efficiency and productivity to scale operations

- Streamline and enhance client reporting processes

Client testimonial:

Revolutionizing Investment Strategies

“SSGA has enhanced its investment and portfolio construction approach through the integration of the PFaroe E&F tool. Its data visualization tools have streamlined the way we interpret complex financial data. The interactive dashboards provide a clear picture of our investment performance – facilitating the identification of areas for improvement.

PFaroe has transformed our approach to spending studies and asset management. Its insights and modules have enabled us to optimize our investments and help our clients to achieve their desired outcomes. We look forward to harnessing the tool’s full potential as we continue to evolve our E&F strategy to meet client needs in a rapidly changing investment landscape.” – Douglas Kanner, FSA OCIO Investment Strategist

Contact us

Visit https://pfaroe.moodysanalytics.com to learn how PFaroe E&F can help you.