RiskFirst is a market-leading fintech company that is revolutionizing risk management in the global pensions and investments markets with pioneering risk analytics and reporting solutions. In the year of the company’s 10th anniversary, being recognized as providing the UK’s Most Reputable Risk Reporting Solution by CEO Monthly is testament to its huge impact on the industry over the past decade. Here, CEO Matthew Seymour discusses what makes RiskFirst unique, its commitment to enhancing the industry and why 2019 has been one of RiskFirst’s most exciting years to date.

RiskFirst has come a long way since its initial product, PFaroe DB, was launched in 2009 to transform asset and liability risk management in the defined benefit (DB) pensions industry. In an industry known for infrequent analysis and opaque reporting – which left it out-of-step with modern standards of corporate governance – PFaroe’s real-time and online nature was truly ground-breaking.

Indeed, the press release at the time of the launch included a prophetic quote from the CEO of one of PFaroe’s earliest beta customers: “In a few years’ time we will ask ourselves how we ever managed without a tool like this.”

Fast-forward ten years and so it has played out. Under the leadership of Matthew Seymour, who was appointed CEO in 2016 after seven years at the company, RiskFirst’s reputation and client base has swelled – so much so that its world-class technology is now the industry standard for UK and US asset owners and consultants. Over 3000 pension plans with more than US$1.4 trillion in assets are now modelled on PFaroe. The company’s client list includes household names such as Mercer, USS, Northern Trust, XPS Pensions Group, NEPC, PNC, Transamerica and Vanguard.

PFaroe: a unique, market-leading solution

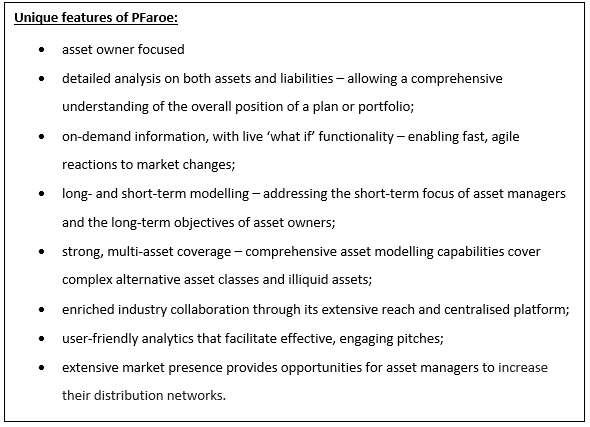

RiskFirst’s success can be attributed to its unwavering commitment to solving industry problems: unlike other asset management technology products, which focus exclusively on the needs of portfolio/asset managers, PFaroe centres upon the needs and objectives of the asset owner. This means that not only is asset performance addressed, but asset managers can also analyse cross-balance sheet risk using tools such as ‘what if’ scenario stress-testing; while optimisation analysis allows them to design solutions that maximise the likelihood that the assets ultimately meet the asset owner’s liabilities.

Seymour knows what it takes to create a successful fintech. Prior to RiskFirst, he co-owned FundWorks, a globally-leading fintech servicing the investment management industry with 30 blue chip clients across seven offices and 90 staff. FundWorks was sold to Kurtosys in 2009 (and Seymour moved on to RiskFirst).

“Core to our ethos is ensuring all of our products have an eye on the ‘ultimate goal’, the asset owners’ true objective,” explains Seymour. “This harks back to our heritage of producing technology for asset owners and continues to prove of great value to consultants and asset managers, providing the unique ability to bring together all of those parties engaged in the process. It genuinely changes the way the various parts of the chain work together, for the good of the asset owner.”

PFaroe, free from legacy constraints, was built from the ground-up as a cross-balance sheet asset and liability management tool. It provides a level of understanding of the overall position of a plan or portfolio that cannot be matched by similar tools that are asset-focused tools with a liability add-on, or vice versa.

This is particularly important in today’s complex landscape, where evolving regulations, an increased focus on de-risking strategies, combined with more options and freedoms on the liability side and a greater variety of alternatives on the asset side, are making risk management particularly challenging. By connecting assets and liabilities, stakeholders can access a holistic understanding of risk, helping them to effectively structure portfolios and implement optimized solutions.

Furthermore, PFaroe’s delivery of information in real-time – as well as its live ‘what if’ functionality – is nothing short of a game-changer, enabling pension plans and asset managers to react more quickly to market changes. PFaroe’s ability to undertake effective modelling and scenario planning are particularly important due to the growing market emphasis on contingency planning – further fuelled by Brexit – and the need for pension funds to have a more robust financial plan in place given increasing market complexity. Being able to undertake effective

modelling and scenario planning is therefore now crucial, and PFaroe is a key facilitator of this. Calculations that previously might have been run overnight can now be completed in minutes, transforming decision-making.

Dedicated innovators

Innovation is at the heart of the business, and RiskFirst is continually evolving PFaroe and launching new solutions targeted at enhancing the institutional investment market, particularly endowments and foundations and the front-office of investment managers.

“RiskFirst thrives on continually helping pension plans gain a better understanding of risk, make better decisions and capture de-risking opportunities through the use of innovative technology solutions,” says Seymour. “We work with clients to provide the support and tools they need to enhance and grow their businesses – delivering comprehensive and innovative solutions that make and save our clients money.”

As part of its commitment to innovation, RiskFirst formed three ground-breaking partnerships in 2018/19, further cementing PFaroe’s position as the risk management platform of choice for the pensions industry, and adding significant value to the market as a whole. Firstly, RiskFirst and STOXX launched the first independent set of liability driven investment (LDI) indices targeting the needs of UK pension plans; allowing

increased insight and more accurate comparisons of asset manager

performance for the LDI market. It was previously believed that the market was too complex for such an initiative, making this a particularly innovative development for the LDI space.

Secondly, together, RiskFirst and Insight are enhancing the ease of fund modelling for the UK DB pensions market, with data on Insight’s funds now accessible in PFaroe. This is transforming how clients can view and analyse funds, creating a central point of access that improves transparency, convenience and efficiency. Thirdly, RiskFirst’s final partnership links PFaroe with the longevity analytics produced by Club Vita. Valuations can therefore be run with ease within PFaroe,

enabling fast and customised mortality projections.

Seymour comments:

“Our products are continually being developed and adapted to address changing market needs and to join up analytics so that clients can rely on scalable, leading-edge products that are flexible, intuitive and ever-evolving.”

Reaching New Markets

In another ground-breaking project, RiskFirst is developing a set of cutting-edge solutions for the asset management community that could

transform the way asset managers incorporate risk and attribution into the investment process.

RiskFirst consulted with the market for 18 months to obtain a thorough

understanding of stakeholders’ needs. It became clear that existing solutions were typically legacy systems, built on an overnight batch process, with every stakeholder using a different system/model to meet their specific needs:

- Portfolio managers require fast, detailed, daily information

- The middle office needs a robust, scalable system with monthly updates

- Asset owners and consultants need a holistic view across the portfolio

Despite these differences, RiskFirst identified that

the underlying needs of the different stakeholders are in fact aligned. RiskFirst has therefore built a next generation risk and attribution solution – PFaroe Attribution – which is a common platform for all stakeholders, bringing together intelligent, modern technology and flexible attribution.

RiskFirst’s solution seeks to embed attribution firmly into portfolio managers’ strategies and pre-trade process; providing the ability to make decisions and allocate asset owner capital based on attribution trends from the decisions they have made over time. Both asset owners and portfolio managers are therefore provided with greater transparency and understanding of whether decisions paid off, and at what cost in terms of risk.

The next chapter

As part of its next stage of growth, RiskFirst joined Moody’s Corporation

during Q3 2019 and now operates under Moody’s Analytics. With a global presence and a number of synergistic products and expertise, Moody’s Analytics will allow RiskFirst to expand the reach of its existing solutions and broaden its offerings.

“The combination of Moody’s Analytics scale, reach and capabilities with our leading solutions and extensive customer base creates an incredibly strong value proposition,” says Seymour. “It gives us enhanced capabilities while building on what has made us so successful to date: a sophisticated, technically excellent product combined with superior service and support. We are excited to embark on this next chapter of RiskFirst’s journey with Moody’s.”

As part of this, RiskFirst plans to accelerate its growth further into

attribution and the buy-side, providing more functionality for the front office of investment managers and extending geographically, including expansion into Canada.

In the 10 years since RiskFirst launched, it has delivered astonishing growth. It is making real value-added change to risk management across the pensions and investments space, and continues to progress and develop its offerings through technological innovation and cutting-edge partnerships. As RiskFirst celebrates 10 years of success, the future looks bright.

This article was originally published by CEO Monthly, November 2019